100+ Compliance Statistics for 2026

Compliance programs underpin data protection, privacy and risk management across every industry, and the numbers show how rapidly the landscape is evolving. This article compiles exactly 100 unique statistics from authoritative 2023–2025 reports and regulatory summaries to help security leaders benchmark their programs and assess regulatory exposure.

Key Categories of Statistics

- Global compliance trends: adoption of frameworks, complexity and digital‑transformation drivers.

- Payment and data‑protection mandates: PCI DSS, HIPAA, ISO 27001 and GDPR adoption, data‑sovereignty priorities and enforcement activity.

- Threat vectors and compliance training: AI‑enabled breaches, automation, risk management maturity and training program characteristics.

- Industry‑specific impacts: insights for financial services, technology, manufacturing, healthcare and government sectors.

- Regional and country‑level breakdowns: average breach costs, GDPR fines and notification trends.

- Major breaches and risk management: cost differentials, third‑party diligence and challenges in ISAE/SOC reporting.

- Cost and vendor complexity: budgets, cloud‑adoption barriers, vendor counts and tool sprawl.

- Human impact on compliance teams: staffing shortages, expanded responsibilities and privacy‑program challenges.

Global Compliance Trends

- Digital‑transformation demand: 71% of companies expect to support digital‑transformation initiatives that require compliance involvement within the next three years. (PwC)

- New business models: 41% anticipate needing compliance support for new business models. (PwC)

- Growing complexity: 85% report that compliance requirements have become more complex over the last three years. (PwC)

- Impact on growth: 77% say rising regulatory complexity is constraining growth and innovation. (PwC)

- IT system challenges: nearly 90% say regulatory complexity hinders implementing new IT systems. (PwC)

- AI adoption barrier: two‑thirds of companies state that compliance complexity limits their use of artificial intelligence. (PwC)

- Top challenges: 47% rank regulatory complexity as their primary challenge, 34% cite organizational complexity, 29% note cultural issues and 28% identify resource capacity. (PwC)

- Technology adoption: 49% of organizations already use technology for more than 11 compliance activities. (PwC)

- Training and monitoring tech: 82% use technology for compliance training, 76% for risk assessment, 75% for monitoring and customer due diligence, and 72% for regulatory disclosures. (PwC)

- Investment plans: 82% plan to increase spending on compliance technology. (PwC)

- Coordination benefits: 59% report better decision‑making when compliance is coordinated across the organization. (PwC)

- Leadership ambition: only 7% consider their organizations compliance leaders today, but 38% aspire to be leaders within three years. (PwC)

- Centralized GRC: 91% of organizations have a centralized governance, risk and compliance team. (Hyperproof)

- Budget outlook: 63% expect risk and compliance budgets to increase in 2025. (Hyperproof)

- Team growth: 72% plan to expand compliance teams in the next two years. (Hyperproof)

- 89% of compliance professionals say AI helps speed up internal compliance functions and supports the compliance process across the compliance landscape. (Thomson Reuters Future of Professionals Report 2024)

- 41% of financial firms in 2024 expect to spend over 10% of digital budgets on Generative AI to meet compliance responsibilities and support enhanced evidence mapping in the compliance industry. (Protiviti)

- 71% of respondents say AI will positively affect effective compliance and help implement continuous compliance across multiple frameworks.(PwC Global Compliance Survey 2025)

- Nearly 90% of compliance professionals see AI as a force for good for ensuring compliance programs across the compliance landscape. (Thomson Reuters)

- 63% of executives say disaggregated data makes compliance harder, stressing data management and the compliance process.(PwC Global Compliance Survey 2025 PDF)

- 77% of breached records in 2024 involved third party vendors, raising third party compliance and financial crime concerns in the compliance industry (BlueSight 2025 Breach Barometer Annual Report PDF)

- Over 90% false positive rates in AML show financial crime control challenges and weaknesses in some compliance models. (Flagright)

- 76% of executives said rising compliance complexity negatively impacted establishing and maintaining third party relationships and alliances. (PwC Global Compliance Survey 2025 )

- 41% of CISOs say third party visibility is the top priority for supply chain cyber resilience and third party compliance. (Accenture Cybersecurity Resilience Report 2024 PDF)

- 40% of legal, compliance, and privacy leaders selected strengthening third-party risk management as a top five priority. (PwC Global Compliance Survey 2025 PDF)

- 35% of business and tech executives rank third party breaches among top threats, linking third party compliance to cyber resilience risk. (KPMG Third Party Risk Management Outlook 2024 )

- SOC 2 examinations can cover 5 Trust Services categories: Security, Availability, Processing Integrity, Confidentiality, and Privacy. (AICPA)

- TrustNet lists SOC 2 Type II observation windows of 3, 6, 9, or 12 months. (TrustNet)

- Vanta states the total cost of achieving SOC 2 can range from $10K to $80K or more. (Vanta)

Payment And Data Protection Compliance Mandates

- GDPR applicability: 92% of surveyed organizations must comply with the EU General Data Protection Regulation. (Kiteworks)

- PCI DSS applicability: 58% must comply with the Payment Card Industry Data Security Standard. (Kiteworks)

- HIPAA applicability: 41% of respondents overall must comply with HIPAA, and nearly 97% of healthcare organizations do. (Kiteworks)

- Data sovereignty importance: 85% say data sovereignty is critical or very important for compliance. (Kiteworks)

- Annual budgets: 83% allocate at least $100,000 per year for web‑form security and compliance. (Kiteworks)

- Incident prevalence: 88% have experienced at least one web‑form–related security incident in the past two years. (Kiteworks)

- Breach via forms: 44% suffered a confirmed data breach through form submissions. (Kiteworks)

- Bot attacks: 61% were targeted by automated or bot‑driven attacks on web forms. (Kiteworks)

- SQL injection attempts: 47% experienced SQL‑injection attempts against form fields. (Kiteworks)

- Cross‑site scripting: 39% encountered cross‑site‑scripting attacks targeting form fields. (Kiteworks)

- Automated response: 48% use automated incident‑response workflows after detecting web‑form threats. (Kiteworks)

- Financial‑services sovereignty: 93% of financial‑services respondents rate data sovereignty as critical or very important. (Kiteworks)

- Tech sector sovereignty: 86% of technology companies consider data sovereignty critical. (Kiteworks)

- Manufacturing sovereignty: 80% of manufacturing organizations rate data sovereignty as critical. (Kiteworks)

- Healthcare sovereignty: 83% of healthcare organizations consider data sovereignty critical. (Kiteworks)

- Government data collection: 81% of government agencies collect government ID numbers via forms. (Kiteworks)

- FedRAMP and FIPS: 75% of government respondents require FedRAMP authorization and 69% use FIPS 140‑3 validated cryptography. (Kiteworks)

- ISO 27001 adoption: 81% of organizations have adopted ISO 27001 certification, up from 67% in 2024. (A-LIGN)

- HIPAA enforcement volume: the U.S. Department of Health and Human Services has received 374,321 HIPAA complaints and initiated 1,193 compliance reviews, resolving 99% of cases. (HHS)

- Civil penalties: 152 HIPAA cases have resulted in civil monetary penalties totaling $144,878,972. (HHS)

- PCI DSS Requirement 4: 90.5% of organizations were fully compliant with PCI DSS Requirement 4 at interim validation in 2023. (Verizon)

- PCI DSS Requirement 11: only 47.6% were fully compliant with Requirement 11. (Verizon)

- Requirement 1 improvement: full compliance with PCI DSS Requirement 1 improved from 61.8% in 2022 to 74.6% in 2023. (Verizon)

Threat Vectors And Compliance Training Requirements

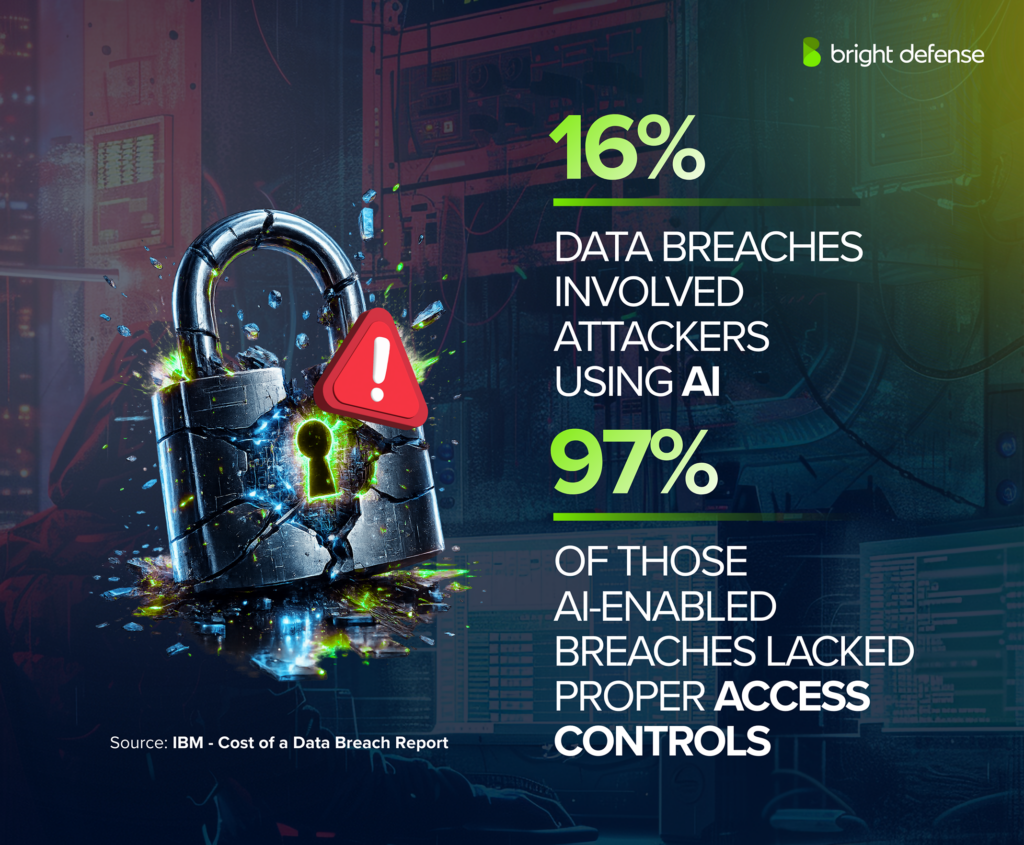

- AI‑driven breaches: 16% of data breaches involved attackers using artificial intelligence. (IBM)

- Access‑control lapses: 97% of those AI‑enabled breaches lacked proper access controls. (IBM)

- AI/automation adoption: 32% of organizations use security AI or automation extensively, 40% use it to a limited extent and 28% do not use it. (IBM)

- Cost of automation: organizations without security AI and automation face average breach costs of $5.52 million, compared with $3.85 million for those that use it extensively. (IBM)

- Ad‑hoc risk management: 60% of organizations with ad‑hoc risk management experienced a data breach in 2024, compared with 41% of those using integrated or automated GRC tools. (Hyperproof)

- Tailored ethics training: 76% of compliance programs tailor ethics training for high‑risk employees. (Navex)

- Language support: 80% of programs offer training in employees’ native languages. (Navex)

- Hotline adoption: 53% of organizations operate a whistleblower hotline; adoption rates are 69% for large companies, 54% for mid‑size firms and 43% for small businesses. (Navex)

- Non‑retaliation policies: only 49% have an official non‑retaliation policy to protect whistleblowers. (Navex)

- Purpose‑built compliance tech: 78% use purpose‑built technology for ethics and compliance training and related program elements. (Navex)

Industry Specific Compliance Impacts

Financial Services Compliance Trends

- Data‑sovereignty priority: 93% of financial‑services organizations rank data sovereignty as critical or very important. (Kiteworks)

- Framework adoption: financial‑services respondents report high adoption rates of ISO 27001, SOC 2 Type II and PCI DSS certification. (Kiteworks)

- Executive reporting: 16% of financial‑services compliance professionals report potential regulatory changes directly to executive teams or boards. (PR Newswire)

- Geopolitical risks: 25% of financial‑services leaders anticipate significant strategic change due to geopolitical risks, and 8% believe those tensions could fundamentally alter their business models. (PR Newswire)

- Change‑management effectiveness: 21% rate their regulatory change‑management approach as somewhat or highly ineffective. (PR Newswire)

- Automation prevalence: 98% of financial‑services respondents automate at least part of their regulatory change‑management process. (PR Newswire)

- Implementation timelines: despite automation, it takes more than a year on average to fully implement regulatory changes. (PR Newswire)

- AI‑regulation volume: the CUBE report recorded 157 AI‑related regulatory insights for financial services in one year. (PR Newswire)

- 56% of enterprises will shift compliance systems to the cloud by July 2025 to maintain compliance in a changing regulatory landscape and support international compliance standardization. (Compliance and Risks)

Technology, Manufacturing, And Healthcare Compliance Impacts

- Sovereignty importance: 86% of technology companies consider data sovereignty critical or very important. (Kiteworks)

- GDPR applicability: 94% of technology companies must comply with GDPR. (Kiteworks)

- PCI applicability: 72% of technology organizations are subject to PCI DSS when handling payments. (Kiteworks)

- Sovereignty priority: 80% of manufacturing organizations rate data sovereignty as critical. (Kiteworks)

- Framework adoption: ISO 27001 adoption is strong among manufacturers, but SOC 2 Type II adoption varies widely. (Kiteworks)

- Legacy systems: manufacturing forms often rely on legacy systems, exposing supplier portals and warranty registration forms to cyber‑attack vectors. (Kiteworks)

- Sovereignty importance: 83% of healthcare organizations consider data sovereignty critical. (Kiteworks)

- HIPAA coverage: nearly all healthcare respondents must comply with HIPAA and 97% collect protected health information through forms. (Kiteworks)

- Attack patterns: healthcare forms experience high rates of cross‑site‑scripting and credential‑harvesting attacks. (Kiteworks)

- High‑value workflows: governments manage applications, benefits, procurement and citizen services through web forms, creating high exposure to bot attacks, credential harvesting and injection attempts. (Kiteworks)

- 56% of organizations in 2025 use purpose built technology for third party risk, signaling higher compliance maturity. (Cohesity)

- Employee hours dedicated to compliance increased 61% from 2016 to 2023. (Bank Policy Institute PDF)

- 40% of compliance teams still relied on basic tools like spreadsheets. (Drata)

- 77% of global C-suite leaders said compliance contributed significantly or moderately to objectives. (Thomson Reuters Institute 2025 C-Suite Survey PDF)

- 69% of risk and compliance professionals said keeping up with laws, policies, and regulations was most important when making decisions. (NAVEX Global Risk and Compliance Statistics)

Regional And Country Level Compliance Breakdowns

- United States breach cost: IBM reports that the average cost of a data breach in the United States exceeds $10 million. (IBM)

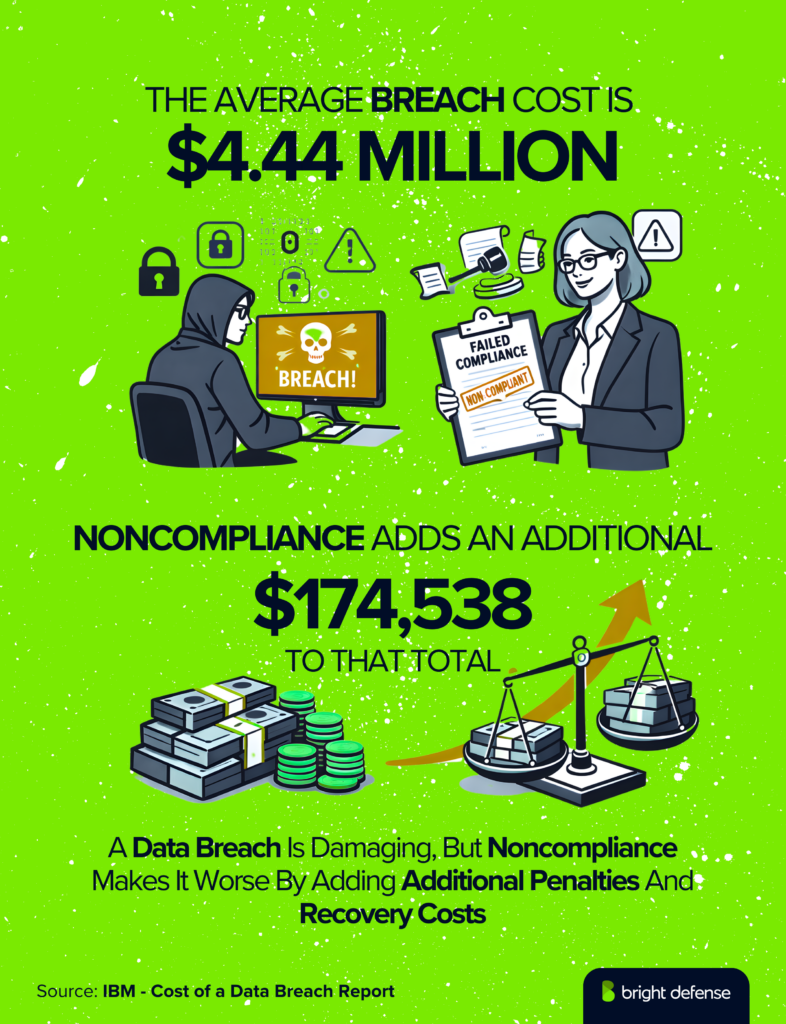

- Global average breach cost: the 2025 global average breach cost was $4.44 million, a 9% decrease from 2024’s $4.88 million. (IBM)

- Noncompliance penalty: failing to comply with regulations adds $174,538 to the average breach cost. (IBM)

- GDPR fines: European supervisory authorities issued approximately €1.2 billion in GDPR fines in 2025. (DLA Piper)

- Breach notifications: notified personal‑data breaches increased by 22% year‑over‑year, reaching an average of 443 notifications per day. (DLA Piper)

- Aggregate fines: since the GDPR took effect in 2018, fines across surveyed jurisdictions have totalled €7.1 billion. (DLA Piper)

- Irish Data Protection Commission: Ireland’s Data Protection Commission has issued €4.04 billion in fines since 2018 and imposed the largest GDPR fine of 2025 (€530 million) for international data‑transfer violations. (DLA Piper)

Major Breaches And Compliance Risk Management

- Shadow AI cost premium: high levels of shadow AI increase average breach costs by $670,000 ($4.74 million versus $4.07 million). (IBM)

- Skill‑shortage premium: a high security‑skills shortage raises breach costs by $1.57 million ($5.22 million versus $3.65 million). (IBM)

- Automation savings: using AI‑driven security automation reduces breach costs by $1.67 million ($5.52 million without automation versus $3.85 million with extensive automation). (IBM)

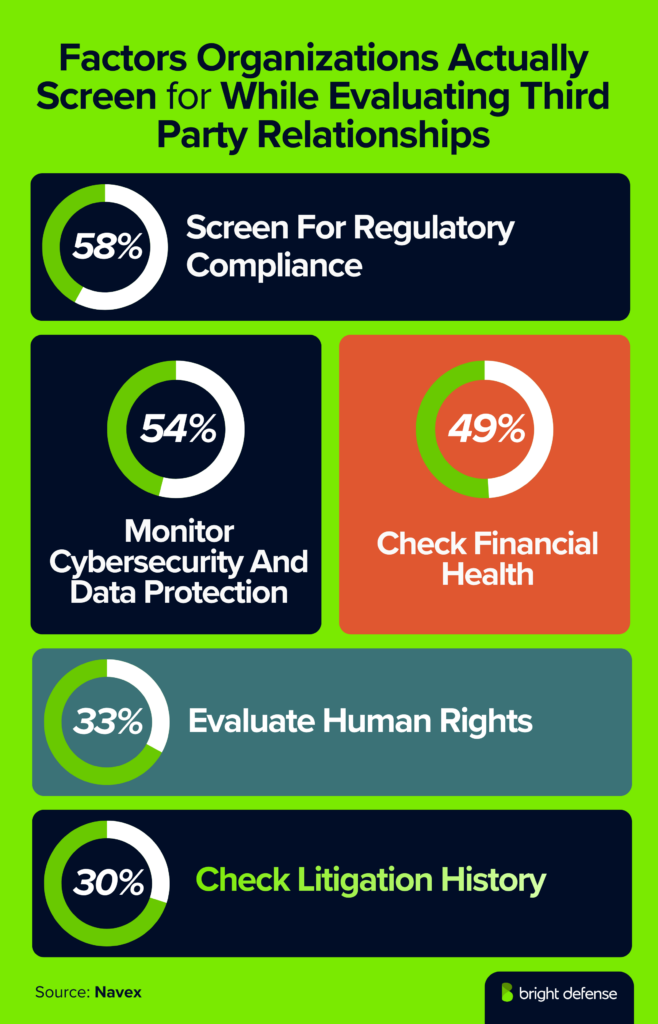

- Third‑party screening criteria: when evaluating third‑party relationships, 58% of organizations screen for regulatory compliance, 54% for cybersecurity and data protection, 49% for financial health, 33% for human rights and 30% for litigation history. (Navex)

- Due diligence effectiveness: 84% agree that rigorous due diligence reduces third‑party risk. (Navex)

- Audit process labour: in Swiss ISAE and SOC reporting, an average of 44 controls per report are mostly manual and require one to five hours each. (KPMG)

- Team size: 63% of Swiss organizations have only one full‑time equivalent working on ISAE or SOC processes; 22% have two to five, 7% have six to ten, 4% have 11–15 and 7% have more than 15. (KPMG)

- Process maturity: 70% rate their ISAE/SOC processes as standardized but primarily manual, while about 20% claim well‑integrated automation supported by GRC tools. (KPMG)

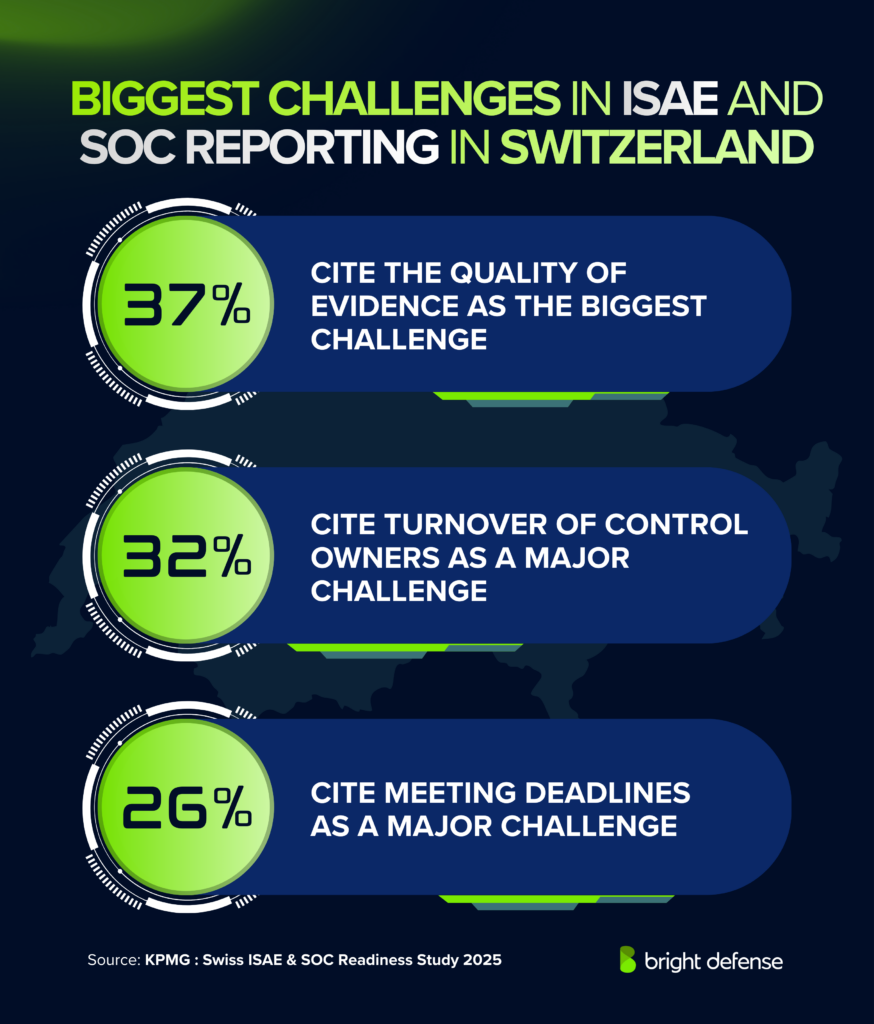

- Evidence quality challenge: 37% cite the quality of evidence as the biggest challenge in ISAE/SOC reporting, while 32% cite turnover of control owners and 26% cite meeting deadlines. (KPMG)

- Manual effort: 59% of controls in Swiss ISAE/SOC reports take one to five hours to execute, while 41% take less than an hour. (KPMG)

Compliance Cost And Vendor Complexity

- Security budgets: 74% of organizations in Hyperproof’s benchmark have annual security budgets above $1 million, while 22% have budgets below that threshold. (Hyperproof)

- Budget constraints: 27% of Fortra survey respondents cite budget constraints as the primary reason for not moving to the cloud. (Fortra)

- Security concerns: 59% of organizations not moving to the cloud cite security concerns, down from 77% the previous year. (Fortra)

- Security vendors: 70% use fewer than ten security vendors, 21% use 11–20, 5% use 21–30, 3% use 31–40 and 1% use more than 50 vendors. (Fortra)

- Confidence in tools: 58% feel confident in their security tool knowledge, 20% are somewhat confident, 19% are very confident and 3% are not confident. (Fortra)

- Tool usage average: companies use an average of more than four tools to manage multi‑state compliance. (Mosey)

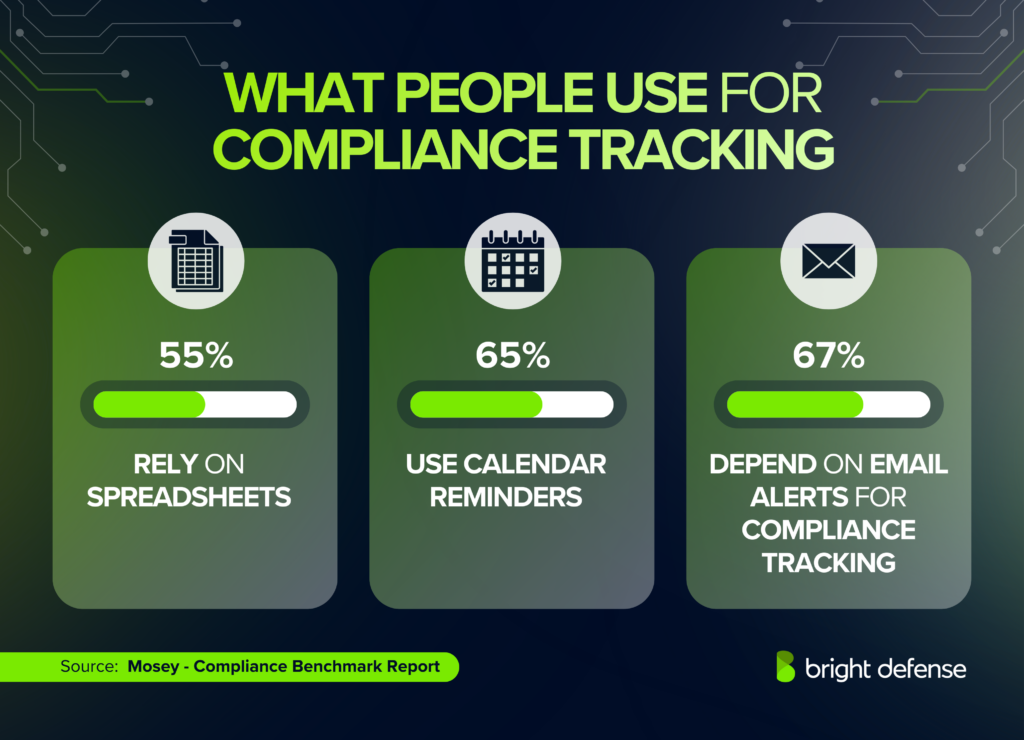

- Manual tracking: 55% rely on spreadsheets, 65% use calendar reminders and 67% depend on email alerts for compliance tracking. (Mosey)

- Compliance software adoption: only 37% have a dedicated compliance software platform, while 63% rely on a patchwork of general business tools. (Mosey)

- Proactive management: only 15% describe their compliance approach as highly proactive and 52% as somewhat proactive. (Mosey)

- Issue discovery: 59% discover compliance issues through state agency notices or penalties. (Mosey)

- Business disruptions: 33% experienced late filings that resulted in penalties, 29% encountered unexpected tax liabilities and 23% had audit findings, while 44% avoided major challenges. (Mosey)

- 58% of respondents reported increased internal compliance costs over the last three years. (Coalfire Securealities Compliance Report 2023 PDF)

- 64% of CEOs viewed the regulatory environment as a barrier to value creation. (PwC CEO Survey 2024)

- 90% of compliance professionals in Asia-Pacific said privacy regulations benefit business. (Cisco 2025 Data Privacy Benchmark Study PD

Human Impact On Compliance Teams

- Skills shortage prevalence: 48% of organizations report a high security‑skills shortage. (IBM)

- Training adoption: more than half of privacy teams report that 90% of employees have completed privacy training, but one in five say fewer than 50% of employees have taken any training. (i app)

- Expanded responsibilities: 80% of privacy teams have taken on responsibilities beyond privacy. (i app)

- AI and data governance duties: 69% of chief privacy officers have assumed responsibilities for AI governance and 69% also oversee data governance and ethics. (i app)

- Challenge prevalence: 99% of privacy professionals report facing challenges delivering privacy compliance; 55% encounter five or more challenges and 15% face ten or more. (i app)

- Data‑protection officers:70% of European organizations have at least one data‑protection officer, whereas only 40% of North American organizations have a DPO and they average fewer than one full‑time position. (i app)

Wanna read similar stat based articles? Check out:

Sources

- Protiviti – The Compliance Playbook: Navigating the Financial Services Industry’s Compliance Priorities in 2025

https://www.protiviti.com/us-en/whitepaper/navigating-financial-services-compliance-priorities-2025

- Navex – 2025 State of Risk & Compliance Report.

- IBM – Cost of a Data Breach 2025.

https://www.bakerdonelson.com/webfiles/Publications/20250822_Cost-of-a-Data-Breach-Report-2025.pdf

- U.S. HHS – HIPAA Enforcement Highlights.

- Hyperproof – 2025 IT Risk & Compliance Benchmark Report.

https://hyperproof.io/it-compliance-benchmarks

- Kiteworks – Data Security & Compliance Risk: 2025 Data Forms Survey.

- PwC – Global Compliance Survey 2025.

https://www.pwc.com/gx/en/issues/risk-regulation/pwc-global-compliance-study-2025.pdf

- Fortra – 2025 State of Cybersecurity Survey.

https://static.fortra.com/corporate/pdfs/guide/fta-2025-state-of-cybersecurity-survey-results-gd.pdf

- PR Newswire CUBE – Cost of Compliance Report 2025.

- A‑LIGN – 2025 Compliance Benchmark Report (ISO 27001 Buyer’s Guide).

https://www.a-lign.com/articles/iso-27001-buyers-guide

- DLA Piper – GDPR Fines & Data Breach Survey 2026.

- KPMG – Swiss ISAE & SOC Readiness Study 2025.

- Mosey – 2025 Multi‑State Compliance Benchmark Report.

https://mosey.com/blog/2025-compliance-benchmark-report

- IAPP – Privacy Governance Report 2024.

https://iapp.org/resources/article/privacy-governance-report

- Drata 115 Compliance Statistics You Need To Know in 2025

https://drata.com/blog/compliance-statistics

- Thomson Reuters Institute 2025 C-Suite Survey.

- Coalfire – Compliance Report 2023

https://assets.coalfire.com/prod/resources/reports/2023-securealities-compliance-report.pdf

- PwC’s 29th Global CEO Survey

https://www.pwc.com/gx/en/issues/c-suite-insights/ceo-survey.html

- CISCO 2025 DATA PRIVACY BENCHMARK STUDY

https://www.cisco.com/c/dam/en_us/about/doing_business/trust-center/docs/cisco-privacy-benchmark-study-2025.pdf

- Bluesight – 2025 Breach Barometer

https://bluesight.com/wp-content/uploads/2025/02/2025-Breach-Barometer-Annual-Report.pdf

- Compliance and Risks – 25 Critical Stats Every Chief Compliance Officer Needs to Know in 2025

https://bluesight.com/wp-content/uploads/2025/02/2025-Breach-Barometer-Annual-Report.pdf

- BPI – Bank Policy Institute Survey

- AICPA – Audit Assurance https://www.aicpa-cima.com/topic/audit-assurance/audit-and-assurance-greater-than-soc-2

- TrustNet – SOC 2 Audit Process https://trustnetinc.com/resources/hub/soc-2/audit-process-timeline-costs

- Vanta – SOC 2 Audit Cost https://www.vanta.com/collection/soc-2/soc-2-audit-cost

FAQ

The most useful compliance statistics for large organizations track regulatory scrutiny and the resourcing decisions chief compliance officers and other compliance officers make inside compliance departments. In KPMG’s survey of 765 leaders, 84% expect increasing regulatory expectations and scrutiny in the next two years, 72% say companies plan to hire more compliance staff in the next year, and 70% anticipate higher technology budgets, which reflects shifting compliance priorities for compliance management in a tighter regulatory environment.

Compliance statistics show program effectiveness when they tie compliance efforts to ongoing monitoring, continuous compliance, and measurable coverage of cyber and privacy regulations and data privacy controls. In the same KPMG survey, 36% rank cybersecurity as a top compliance improvement priority and 35% rank data privacy, while 34% cite new regulatory requirements as the biggest compliance challenge, which helps legal and compliance leaders judge whether the compliance function can maintain effective compliance and prove compliance across a defined compliance framework.

The clearest compliance cost statistics compare what it takes to maintain compliance versus the financial impact tied to failures, including the average global cost and global average cost signals used in enterprise risk management. Ponemon figures cited in industry reporting put the average annual cost of compliance at $5.47 million versus $14.82 million for noncompliance, and IBM’s Cost of a Data Breach reporting places the global average cost at $4.44 million in 2025, a set of numbers that often drives cost savings discussions, compliance AI adoption, and decisions to undertake digital transformation initiatives rather than manage compliance manually.

Compliance statistics reveal regulatory change risk when they measure regulatory developments, the growth of requirements, and the real exposure created by data privacy obligations. KPMG reports 34% of chief compliance officers cite new regulatory requirements as the biggest compliance challenge, and IAPP reports 144 countries have enacted national data privacy laws covering about 82% of the world’s population, which explains why companies plan for data management work that supports multiple frameworks and more compliance involvement.

Compliance maturity shows up in statistics tied to corporate governance, compliance culture, and how well third party risk management connects to enterprise risk management with clear independent function reporting. KPMG reports 41% say ESG compliance programs are still in the planning and development stage, and its 2026 survey reports 53% say their TPRM programs are mostly integrated with ERM while 18% report full integration, which helps benchmark compliance models and third party compliance oversight.

Get In Touch