13 Best SOC 2 Audit Firms in 2026

In 2024, third-party breaches accounted for 35.5% of all incidents, while new disclosure rules now give public companies only four business days to report a material cyber event.

These developments have changed how SOC 2 audits are viewed. The process is no longer limited to verifying strong controls; it now focuses on proving that a security program can withstand detailed examination.

A successful SOC 2 audit depends as much on the auditor as on the controls. The right firm understands the organization’s systems, documentation, and risk environment

In this guide, I’ve highlighted ten SOC 2 audit firms that consistently deliver quality, clarity, and technical expertise.

Note: This is not a ranked list. Placement does not imply superiority.

Key Takeaways

- Third-party incidents made up 35.5% of breaches in 2024

- Public companies now have four business days to disclose material cyber events

- SOC 2 now tests evidence of real-world security, not paperwork

- Auditor quality and fit can determine audit speed and results

- The firms listed are selected for quality and clarity, not ranked

13 Best SOC 2 Audit Firms

Here’s a focused list of the SOC 2 audit firms we’ll cover, with details on founding year, founders, and the attributes that set each firm apart in how it delivers SOC 2 audits. For a quick comparison, here is a table you can check:

1. Prescient Security – Risk-Based Global SOC Audit and Testing Firm

Founded in 2018, Prescient Security is a cybersecurity and compliance firm specializing in cloud-native technologies and modern application security. It provides penetration testing, compliance audits, and attestation services across more than 25 frameworks in the U.S., Europe, Australia, and Asia-Pacific.

Led by co-founders Fabrice Mouret (CEO) and Sammy Chowdhury (CCO), the company has delivered thousands of SOC 2, ISO, and penetration testing engagements. It is CREST and CSA STAR certified and serves over 5,000 clients.

Prescient follows a risk-based audit approach, offering SOC, HIPAA, GDPR, CCPA, PCI, and ISO certifications with fast turnaround times, flexible terms, and direct access to senior auditors. Clients note that its methodology minimizes unnecessary controls and simplifies compliance.

Prescient Company Overview

- Company Name: Prescient Security (Prescient Security LLC & Prescient Assurance LLC)

- Headquarters: 25 West 36th Street, 11th Floor, New York City, New York 10018, United States

- Year Founded: 2018

- Global Presence: Operates across the U.S., Europe, and APAC; serves clients in regions including North America, South America, Australia, Asia, and Europe

- Website: prescientsecurity.com

- Founders: Fabrice Mouret (CEO); Sammy Chowdhury (Chief Compliance Officer)

Key SOC 2 Features

- Risk-based audits: SOC 2 audits are customized to each client’s risk profile, avoiding irrelevant controls.

- Multiframework accreditation: Authorized to issue SOC 1, SOC 2, HIPAA, GDPR, CCPA, PCI, and other certifications; also CREST and CSA STAR certified.

- Broad compliance coverage: Supports more than 25 frameworks, including ISO 27001/27701, HITRUST, FedRAMP readiness, and CIS Top 18.

- Cloud-native and AI-supported testing: Focuses on cloud technologies and uses AI tools to optimize penetration tests and evidence collection.

- Global operations: Over 200 staff members across multiple regions provide around-the-clock support and direct access to senior auditors.

- GRC partnerships: Integrates with platforms such as Vanta, Drata, and Trustero for connected compliance workflows.

Pros

- Led by Fabrice Mouret and Sammy Chowdhury, both highly certified with long IT experience.

- Completed over 3,600 SOC 2 audits, 4,800 penetration tests, and served 5,000+ clients.

- Uses a risk-based audit model to cut unnecessary controls and reduce costs.

- Holds AICPA, CREST, CSA STAR, PCI QSA, and ISO accreditations.

- Global team across the U.S., Europe, and APAC with regional expertise.

- Delivers quick audits, direct partner access, and flexible payment options.

2. Johanson Group LLP – Boutique CPA Auditor with Hands-On Delivery

Johanson Group LLP, a Colorado-based CPA firm, specializes in security and compliance audits, including SOC 1, SOC 2, SOC 3, ISO 27001, and HIPAA. Its three-step SOC 2 process covers project scoping, audit execution, and report delivery, assessing SOC 2 controls against the five Trust Services Criteria.

Known for efficiency and personal service, Johanson delivers final SOC 2 reports within four to six weeks. Its smaller size allows clients to work directly with certified auditors, offering a clear and accessible audit experience.

Johanson Group LLP Overview

- Company Name: Johanson Group LLP

- Headquarters: Colorado Springs, Colorado, USA

- Year Founded: 2014

- Global Presence: Serves clients across the United States and internationally through virtual audits; operates as a boutique auditor with a small, specialized team rather than a large network

- Website: johansongroupllp.com

- Founders / Leaders: Stewart Riley (Managing Director), with partners Tom Miller, Steven Miller, and Ryan McBride

Key SOC 2 Features

- Readiness assessments and gap analysis: Conducts pre-audit reviews to identify control gaps and recommend remediation steps.

- Licensed CPA audit firm: Provides SOC 1, SOC 2, and SOC 3 attestation services, ISO 27001 certification support, and HIPAA, GDPR, and NIST assessments.

- Three-step audit process: Includes consultation, audit execution, and report delivery; emphasizes efficient scheduling and a rapid completion timeframe.

- Multiple frameworks: Offers additional assessments for PCI DSS, CCPA, and other frameworks to help organizations consolidate compliance efforts.

Pros

- Clients work directly with auditors for responsive, personalized support.

- Delivers final SOC 2 reports within four to six weeks of testing.

- Offers SOC, ISO 27001, HIPAA, and privacy assessments for varied compliance needs.

3. Sensiba – 100 CPA firm and B Corp for fixed-fee SOC 2

Sensiba LLP, founded in 1977, is a certified public accounting and advisory firm based in Northern California. It ranks among the top 100 U.S. accounting firms and is California’s first accounting B Corp.

The firm’s SOC 2 practice helps startups and public companies meet the five Trust Services Criteria through readiness assessments, gap remediation, evidence collection, and monitoring. Sensiba’s team includes CPAs and information security professionals skilled in AWS, GCP, Azure, and automation tools like Drata, Secureframe, Sprinto, and Vanta.

They offer fixed-fee pricing that cuts costs by about 25–30 percent, deliver most reports within 30 days after the audit period, and use AI analytics for faster evidence review. Sensiba’s global network provides local expertise with a single point of contact.

Company Overview

- Company Name: Sensiba LLP (formerly Sensiba San Filippo LLP)

- Headquarters: San Ramon, California, USA (2700 Camino Ramon, Suite 140)

- Year Founded: 1977

- Global Presence: Top-100 U.S. accounting firm with offices across California; network of certified auditors provides services worldwide

- Website: sensiba.com

- Founders: Steve San Filippo (founder); CEO John D. Sensiba leads the firm today

about 25% (sensiba.com)

Key SOC 2 Features

- Readiness and remediation support: Performs gap assessments, recommends corrective actions, and supplies sample controls and evidence. Auditors help write policies and map controls to the Trust Services Criteria.

- Combined audits: Clients can combine SOC 2 with ISO 27001, PCI DSS, or HIPAA to save time and expense.

- Cloud and automation expertise: Works with AWS, GCP, and Azure environments; familiar with Drata, Secureframe, Sprinto, and Vanta for efficient evidence collection.

- AI-driven auditing: AI tools analyze compliance data to identify gaps and speed up report drafting.

- Fixed-fee pricing and fast turnaround: Most SOC 2 reports are issued within 30 days; fixed-fee pricing offers predictability and often lowers costs.

Pros

- More than 40 years in public accounting and early adoption of B Corp values build credibility.

- Peer-reviewed CPA firm with auditors who hold CISA and CISSP credentials.

- Clients receive a dedicated success manager and guidance through readiness, remediation, and evidence collection.

- Fixed-fee structure helps small and mid-sized companies budget effectively and often saves money compared with hourly billing.

4. Zero Day CPA – SOC 2 and HIPAA Auditor with Flexible Delivery

Zero Day CPA, PC is a Michigan-based boutique accounting firm specializing in SOC 1, SOC 2, SOC 3, and HIPAA audits for B2B SaaS and service organizations.

The firm conducts readiness assessments, gap analyses, and full SOC 2 Type I, Type II, and combined Type II + audits aligned with frameworks like HIPAA and PCI DSS.

Known for direct communication and flexibility, Zero Day manages both on-site and remote engagements, clearly defining scope, timelines, and deliverables. Clients note responsive auditors and early report delivery.

Founded by CEO Lance Samona and CTO Patrick Sesi, the firm operates through a network of specialists and applies a risk-based approach tailored to each client’s security posture.

Company Overview

- Company Name: Zero Day CPA, PC

- Headquarters: West Bloomfield, Michigan, USA (6476 Orchard Lake Road)

- Year Founded: Not publicly disclosed; operating since early 2020s

- Global Presence: Boutique firm serving U.S. clients; provides remote audits with a team of 10–50 professionals

- Website: zerodaycpa.com

- Founders / Leaders: Lance Samona (Founder & CEO)

Key SOC 2 Features

- Readiness assessments: Evaluates control maturity, identifies weaknesses, and offers targeted remediation steps before formal testing.

- Customizable engagement types: Provides SOC 2 Type I, Type II, and Type II+ audits that incorporate frameworks such as HIPAA or PCI DSS.

- Flexible delivery: Supports both on-site and remote audits; auditors maintain clear communication and schedule checkpoints during the process.

- Transparent communication: Clients receive consistent status updates, access to draft reports, and the opportunity to review findings before finalization.

- Industry coverage: Works with healthcare, financial, and technology companies seeking SOC and HIPAA attestations.

Pros

- Deep focus on SOC and HIPAA engagements allows precise alignment with trust criteria.

- Clients report clear communication and quick turnaround times.

- Small-firm setup enables custom scoping and scheduling for each client; audits can be conducted remotely or in person.

- Readiness reviews prioritize the most significant control gaps to help clients succeed in final audits.

5. Insight Assurance – Trained SOC 2 and Multi-Framework Audit Team with 24/7 Support

Insight Assurance, founded in 2019 by former Big 4 professionals Jesus Jimenez and Felipe Saboya, is a Tampa-based audit and cybersecurity firm focused on simplifying compliance for fast-growing companies. The firm doubled its recurring revenue from $5 million to $10 million in 2024 and operates across North America, Europe, and Asia Pacific.

The company runs through a dual structure: Insight Assurance LLC provides CPA-licensed audit services, while its consulting arm handles advisory work. It reports over 3,500 compliance engagements, 1,500 active clients, a 97 percent retention rate, and leadership with more than 20 years of average experience.

Audits are powered by AI tools for faster turnaround and real-time visibility. Services cover SOC 1/2/3, ISO 27001, PCI DSS, HIPAA, GDPR/CCPA, FedRAMP, CMMC, penetration testing, and risk assessments. Clients also receive 24/7 auditor support.

Company Overview

- Company Name: Insight Assurance (Insight Assurance LLC and affiliated entities)

- Headquarters: Tampa, Florida, USA (400 N Tampa St, Suite 129)

- Year Founded: 2019

- Global Presence: Teams across North America, Europe, and APAC; services clients on multiple continents

- Website: insightassurance.com

- Founders: Jesus Jimenez (Managing Partner & Co-founder) and Felipe Saboya (Co-founder)

Key SOC 2 Features

- Big-4 expertise with agile execution: Audits are led by former EY and PwC professionals, combining rigorous methodology with flexible engagement models.

- Global reach: Teams in North America, Europe, and APAC allow auditing aligned with regional regulations.

- AI-driven efficiency: Automated tools streamline evidence collection and reduce audit timelines.

- 24/7 client support: Clients gain real-time access to auditors and support at any time, reducing bottlenecks.

- Comprehensive framework coverage: Provides SOC 1/2/3, ISO 27001, PCI DSS, HIPAA/HITECH, GDPR/CCPA, HITRUST, FedRAMP, CMMC, and other certifications.

- High client retention: 97% retention rate and 3,500+ engagements completed demonstrate consistent performance.

Pros

- Founders and directors hold CPA, CISA, QSA, CISM, and other certifications; many formerly worked at Big 4 firms.

- Ability to handle audits across multiple frameworks makes Insight Assurance suitable for startups and enterprises seeking unified compliance.

- Reduces audit timelines and provides continuous insight into compliance status.

- Offices and staff across several regions support clients with global operations.

- 97% client-retention rate suggests high satisfaction and long-term relationship.

6. PwC – Enterprise SOC 2+ and Multi-Attestation Leader

PwC, one of the Big Four accounting firms, operates in over 150 countries and employs hundreds of thousands worldwide. Its Digital Assurance & Transparency practice produces SOC 2 reports and the proprietary SOC 2+ service. Auditors conduct readiness assessments, identify control gaps, and provide recommendations before formal examinations.

SOC 2+ extends assurance to frameworks such as NIST, HITRUST, and GDPR, while the SECO program coordinates multiple attestations to reduce cost and disruption. PwC’s SOC 2 practice benefits from global scale, technical depth, certified professionals, and industry-specific expertise, earning recognition as a leading SOC 2 auditor.

PwC Company Overview

- Company Name: PricewaterhouseCoopers (PwC)

- Headquarters: London, England (global headquarters); U.S. firm headquartered in New York City

- Year Founded: 1998 (merger of Price Waterhouse and Coopers & Lybrand)

- Global Presence: Operations in more than 150 countries; 175,004 clients; over 364,782 professionals worldwide

- Website: pwc.com

- Founders: Samuel Price, William Cooper, and others (founders of legacy firms)

Key SOC 2 Features

- Readiness and gap review: PwC performs a preliminary assessment against the attestation framework, highlights control gaps, and suggests fixes before the audit.

- Custom SOC 2 and SOC 2+ reports: Clients receive SOC reports specific to their systems and sector, with SOC 2+ options adding frameworks like HITRUST, GDPR, or NIST.

- SECO program: A coordinated management service that handles multiple attestations, cutting cost and reducing audit disruption.

- Wide attestation range: Services include SOC 1, SOC 3, SWIFT, viewership data, and other sector-focused attestations.

- Certified audit team: PwC’s auditors hold CPA, CISA, and COBIT credentials with strong industry experience.

Pros

- Global scale with operations in more than 150 countries and local audit teams to support multinational clients.

- Broad service range including SOC 2, SOC 2+, SOC 1, and other attestation reports for consolidated compliance under one provider.

- Customizable SOC 2+ reports that integrate frameworks such as HITRUST, GDPR, and NIST for greater flexibility.

- Strong reputation backed by Big Four status and industry recognition for credibility and trust.

7. BARR Advisory – SOC 2 Audit Firm with an Accredited ISO 27001 Cert Body

BARR Advisory, founded in 2014 by Brad Thies, is a Kansas City–based cybersecurity and compliance firm serving startups and Fortune 1000 companies. It operates in over 20 countries and is among the few U.S. firms accredited for both ISO 27001 certification and SOC 2 audits.

Its adaptive audits cut client effort by roughly 75%. The team holds CPA, CISA, CISSP, and CIPP credentials, delivering fixed-rate services and reports up to 40% early.

With a remote-first structure, BARR provides consistent pricing and global access to skilled professionals. Clients highlight its clarity, reliability, and automation integration. With a net promoter score of 89 and high retention, it stands out as a dependable SOC 2 and ISO compliance partner.

BARR Advisory Company Overview

- Company Name: BARR Advisory

- Headquarters: Kansas City, Missouri, USA

- Year Founded: 2014

- Global Presence: Remote-first firm serving clients in 20+ countries across six continents

- Website: barradvisory.com

- Founder: Brad Thies

Key SOC 2 Features

- Boutique service with global expertise: BARR combines personal attention with the ability to serve clients worldwide.

- Certified professionals: Staff hold CPA, CISA, CISSP and privacy certifications; the firm is accredited for both SOC and ISO 27001 audits.

- Fixed-fee pricing: Targeted at growing enterprises, allowing predictable budgeting.

- Integration with compliance automation tools: BARR partners with leading platforms so clients can collect evidence more efficiently.

- Adaptive methodology: Practical SOC 2 approach that claims to reduce client effort by 75%.

Pros

- Remote-first model taps a broad talent pool and supports clients across continents.

- Boutique feel with dedicated teams and fixed rates targeted at growing enterprises.

- Accredited to perform both SOC 2 and ISO 27001 audits, offering a one-stop solution for multiple frameworks.

- Emphasis on practical, adaptive audits reduces the time clients spend gathering evidence.

- High net promoter score and nearly 100% client retention reflect strong satisfaction.

8. A-LIGN – High-Volume SOC 2 Audit Firm with an End-to-End Audit Platform

Founded in 2009 by Scott Price, A-LIGN is a Tampa-based SOC 2 auditing firm with offices in Panama City, Sofia, Gurugram, and Galway. It serves over 5,700 clients and has completed more than 31,000 audits.

The firm provides SOC 1 and SOC 2 reports, ISO certifications, HITRUST assessments, and FedRAMP authorizations through its A-SCEND platform, which centralizes audit evidence and tracking. With more than 400 auditors and a 96% satisfaction rate, A-LIGN is known for quick response times and practical audit guidance.

Still privately owned, Price, a CPA and CISA, continues to lead the company and maintain its reputation as a trusted global SOC 2 provider.

A-LIGN Company Overview

- Company Name: A-LIGN

- Headquarters: Tampa, Florida, USA

- Year Founded: 2009

- Global Presence: Offices in Panama City (Panama), Sofia (Bulgaria), Gurugram (India) and Galway (Ireland); serves over 5,700 clients worldwide

- Website: a-lign.com

- Founder: Scott Price

Key SOC 2 features

- A-SCEND audit management platform: Centralizes evidence collection, document storage and issue tracking, integrating with governance, risk and compliance software.

- Extensive auditing experience: More than 31,000 audits completed and 200+ SOC auditors.

- Multi-framework capability: Licensed to conduct SOC 1/SOC 2 audits, ISO 27001 certifications, HITRUST assessments and FedRAMP evaluations from a single provider.

- Global staff and offices: Locations in North America, Europe and Asia allow follow-the-sun support.

- High customer satisfaction: 96% client satisfaction and 24-hour response commitment.

Pros

- Deep experience in SOC 2 reports; completes high volumes of audits.

- Integrated A-SCEND platform reduces manual tasks and supports multiple compliance frameworks.

- Licensed to perform SOC 1, SOC 2, ISO 27001 and FedRAMP assessments, enabling “one-stop” compliance.

- Global offices and large auditor pool provide scale and responsiveness.

- Founder-led leadership with CPA and CISA credentials adds credibility.

9. Schellman & Company – Specialist Assessor with a Large SOC 2 Practice

Schellman & Company, founded in 2002 as a two-person firm focused on SAS 70 exams, has grown into a global cybersecurity and privacy assessment leader with over 400 employees. It performs thousands of projects each year and offers nearly 60 types of audits and assessments.

The firm stands apart from the Big Four through fixed fees, direct access to experts, and active principal involvement. It avoids unrelated consulting and delivers draft SOC reports within three weeks and finals within 30 days. CEO Avani Desai credits this focus and consistency with making Schellman the one of the largest specialized cybersecurity assessment firm in the market.

Schellman & Company LLC Company Overview

- Company Name: Schellman & Company, LLC

- Headquarters: Tampa, Florida, USA

- Year Founded: 2002

- Global Presence: Conducts thousands of projects annually for domestic and international clients; expanded from a two-person firm to over 400 employees and is recognized as a global leader in cybersecurity and privacy assessments

- Website: schellman.com

- Founder: Chris Schellman

Key SOC 2 Features

- Specialized service focus: Provides IT audit and compliance attestations without offering unrelated consulting services.

- Fixed-fee pricing: Engagements are priced upfront with no hourly billing.

- Senior-level involvement: Principals and subject-matter experts actively participate in audits to maintain consistent quality.

- Structured methodology: Follows a four-phase process: planning, understanding, testing, and reporting. Communication before and during testing prevents surprises, with draft reports provided within three weeks and final reports within 30 days.

- Largest specialized cybersecurity assessor: After two decades of steady growth, Schellman has become the largest specialized cybersecurity assessment firm.

Pros

- Dedicated exclusively to cybersecurity and compliance, not broader financial audits.

- Fixed-fee model provides predictable costs.

- Disciplined approach and leadership involvement deliver timely, detailed reports.

- Grew from two employees to over 400 professionals and is widely respected in compliance.

10. Baker Tilly – Boutique CPA Auditor with Hands-On Delivery

Baker Tilly, a top-ten advisory, tax, and assurance firm founded in 1931, has grown from a Wisconsin regional practice into a global network spanning more than 140 countries with over 43,000 professionals.

Its risk advisory group provides SOC 2 readiness assessments and attestations led by AICPA-qualified specialists who conduct hundreds of engagements each year.

Services include system inventories, control matrices, gap analyses, and remediation guidance. Baker Tilly also helps clients integrate frameworks such as HIPAA, ISO 27001, HITRUST, or NIST into SOC 2+ reports, serving both mid-sized and large enterprises worldwide.

Baker Tilly Company overview

- Company Name: Baker Tilly US, LLP (member of Baker Tilly International)

- Headquarters: Chicago, Illinois, USA

- Year Founded: 1931

- Global Presence: Member of Baker Tilly International; operates in over 140 countries with more than 43,000 professionals. The firm has merged with over 50 organizations, growing from a local practice into a global network.

- Website: bakertilly.com

- Founder: Ed Virchow

Key SOC 2 Features

- Dedicated SOC specialists: AICPA-qualified experts with cross-industry experience conduct hundreds of SOC engagements annually.

- SOC readiness assessment: Includes system inventory, control matrix, gap list, remediation steps, and system description outline.

- Framework integration (SOC 2+): Allows inclusion of HIPAA, ISO 27001, HITRUST, or NIST frameworks.

- Educational resources: Offers webinars and publications on SOC readiness, vendor due diligence, and emerging topics.

- Global network advantage: Baker Tilly International membership supports multinational coordination and regional compliance insight.

Pros

- Founded in 1931, offering long-standing experience and stability.

- Presence in over 140 countries with 43,000 professionals for global and local support.

- Delivers detailed control matrices and gap analyses for stronger readiness.

- SOC 2+ option supports multiple frameworks for efficient audits.

- Serves mid-sized and large enterprises across many industries.

11. Linford & Company – CPA SOC 2 Specialist with Big Four Pedigree

Linford & Company, a Denver-based CPA firm, specializes in SOC audits and related compliance services. Its team includes auditors and security professionals with Big Four experience and conducts SOC 1, SOC 2, HITRUST, HIPAA, and FedRAMP assessments for clients in the U.S. and abroad.

The firm emphasizes data protection through encrypted collaboration and a distributed workforce. Known for confidentiality, clear communication, and personal attention, Linford guides clients through every stage of SOC 2 readiness and reporting with technical precision and direct support.

Linford & Company Company overview

- Company Name: Linford & Company, LLP

- Headquarters: Denver, Colorado, USA

- Year Founded: 2008

- Global Presence: Serves clients across the United States and internationally with a distributed workforce capable of conducting remote audits

- Website: linfordco.com

- Founders / Leaders: Homan Lajevardi and Dena Dahlquist, both with prior experience at Protiviti and Big Four firms; lead a team of auditors with extensive SOC and risk management expertise

Key SOC 2 Features

- Specialized SOC expertise: Focuses on SOC 1, SOC 2, and HITRUST audits, along with HIPAA and FedRAMP compliance.

- Big Four heritage: Many auditors previously worked at major accounting firms and bring extensive compliance experience.

- Privacy-first culture: Prioritizes data confidentiality through secure, encrypted collaboration and strict information handling protocols.

- Global client support: Serves organizations worldwide with a distributed team structure that accommodates remote engagements.

- Flexible engagement model: Offers readiness assessments, SOC examinations, and regulatory compliance audits within a unified service framework.

Pros

- Specializes in SOC and related compliance audits with deep expertise.

- Auditors have experience from major accounting and consulting firms.

- Prioritizes data protection and encrypted collaboration for client security.

- Supports remote and international clients through secure systems.

12. Control Logics – Readiness-Focused Risk and SOC 2 Audit Consultancy

Control Logics, founded in 2008 and based in Tampa, Florida, provides risk management and audit consulting for more than 250 organizations across North America, Europe, and Asia. Its services cover SOX compliance, Model Audit Rule support, ISO certifications, SOC readiness, and privacy compliance under GDPR and CCPA.

The firm combines boutique-level responsiveness with deep technical expertise. Every consultant has over 15 years of experience and holds certifications such as CIA, CISA, ISO 27001 Lead Auditor, and CFE. Clients value its direct communication, minimal bureaucracy, and competitive pricing.

Control Logics Company Overview

- Company Name: Control Logics, LLC

- Headquarters: Tampa, Florida, USA

- Year Founded: 2008

- Global Presence: Has served over 250 companies across North America, Europe, and Asia; operates as a boutique firm with a centralized structure and technology-supported remote delivery model

- Website: controllogics.com

- Founders / Leaders: Co-founder Homan Lajevardi, a director with over 15 years of SOX and IT audit experience and former Protiviti consultant

Key SOC 2 features

- SOC readiness assessments: Prepares organizations for SOC 2 audits through control gap analysis and remediation recommendations.

- SOX, MAR, and ISO services: Provides SOX compliance audits, Model Audit Rule assistance, and ISO 27001 certification support.

- GDPR and CCPA compliance: Offers practical guidance on privacy regulations and helps clients implement compliant data controls.

- Experienced consultants: Each team member has at least 15 years of audit experience and holds relevant professional certifications.

- Boutique service: Efficient structure and direct client access lead to precise, personalized audits.

Pros

- Consultants average 15+ years of experience with advanced certifications.

- Small team offers flexible, personalized service.

- Serves 250+ clients across North America, Europe, and Asia.

- Provides quality services at lower cost than large firms.

13. Oread Risk & Advisory – SOC Audit and IT Risk Boutique for U.S. Clients

Oread Risk & Advisory is a U.S.-based attestation, information‐security and compliance‐consulting firm headquartered in Olathe, Kansas. They focus on audit and reporting work for service organizations, including SOC 2 engagements that cover criteria such as security, availability, confidentiality, processing integrity and privacy.

Their offering includes readiness assessments, documentation of controls and full audits, giving clients the ability to demonstrate to customers and stakeholders that their systems meet established standards.

They also partner with compliance-platforms to help ease evidence collection and ongoing control monitoring. In short, they present as a strong audit firm for SOC 2 because they specialise in this field, provide a structured process, and have alliances with tooling that reflect modern audit practices.

Company Overview (Oread Risk & Advisory, LLC)

- Company Name: Oread Risk & Advisory, LLC

- Headquarters: Olathe, Kansas, USA

- Year Founded: 2015

- Global Presence: Serves clients throughout the United States, supporting long-term compliance programs through partnerships and remote engagements

- Website: oreadrisk.com

- Founders / Leaders: Principals Raja Paranjothi, Director Mihir Acharya; leadership team has prior experience at CBIZ, Mayer Hoffman McCann

Key SOC 2 Features

- Comprehensive SOC services: Provides SOC 1, SOC 2, and SOC 3 audits, as well as IT risk assessments, HIPAA attestations, PCI consulting, and network vulnerability testing.

- Relationship-driven consulting: Emphasizes trust and long-term client relationships, offering consistent guidance from readiness to reporting.

- Experienced leadership: Senior professionals with Big Four and national firm backgrounds bring extensive experience in governance, risk, and compliance.

- Technology integration: Partnership with Tentacle enables clients to collaborate digitally, track readiness, and centralize compliance evidence.

- Multi-framework coverage: Supports combined assessments incorporating HIPAA, PCI, and ISO 27002 frameworks, coordinating input from other stakeholders to align audit timing and findings with broader compliance goals.

- New engagement reviews: Evaluates systems and controls early in a new engagement to help define scope and prepare stakeholders for audit expectations.

Pros

- Provides SOC audits plus risk, privacy, and security consulting for full compliance support.

- Emphasizes strong client relationships and open communication.

- Led by experienced professionals with Big Four backgrounds.

- Uses digital tools for document management and audit coordination.

- Demonstrates awareness of key areas within compliance operations, helping assure clients of consistent standards across financial reporting and sensitive data handling.

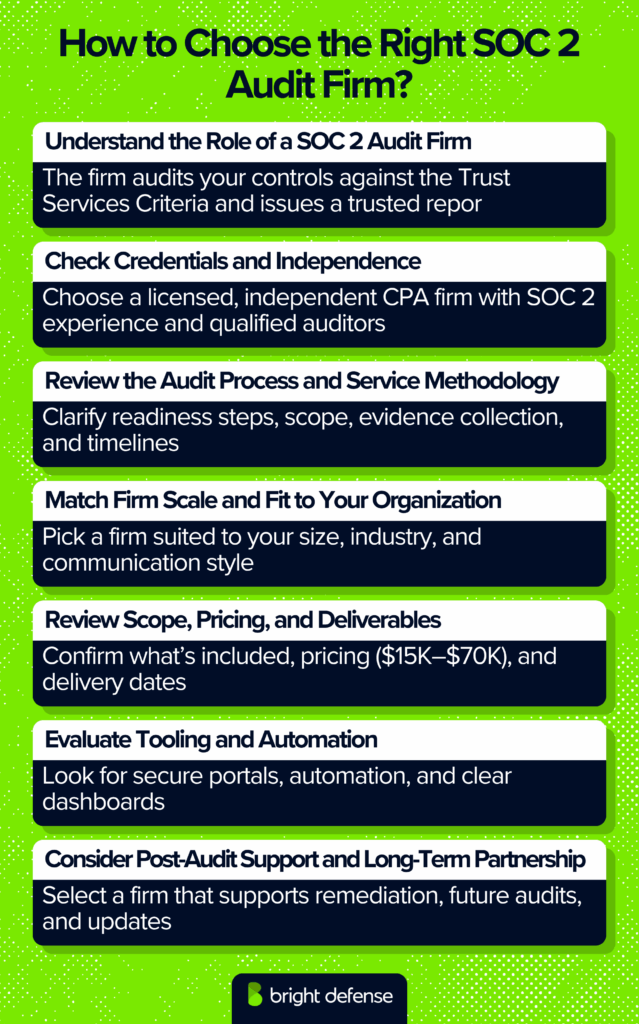

How to Choose the Right SOC 2 Audit Firm?

Selecting a SOC 2 audit firm is one of the most important steps in your compliance program. The right firm does more than check boxes, it provides credible validation of your internal controls, supports your readiness, and shapes your audit experience from start to finish.

1. Understand the Role of a SOC 2 Audit Firm

A SOC 2 firm performs an independent attestation of your control environment against the Trust Services Criteria (TSC). The firm issues a report that your customers, partners, and regulators can rely on to confirm data security and processing integrity.

Your selection directly affects:

- The credibility and quality of the final report

- The guidance you receive before and during fieldwork

- The audit’s cost, scope, and timeline

2. Check Credentials and Independence

Before signing an engagement letter, verify that the firm has the right credentials and an appropriate level of independence. Experienced auditors who follow industry standards can provide deeper insights and identify issues early.

Key points to review:

- Accreditation and licensing: Work with a licensed or registered CPA firm in the U.S.

- Independence: The firm must not have designed or implemented the same controls it will audit. That separation keeps the attestation objective.

- SOC 2 experience: Ask how many SOC 2 audits the firm completes each year. A team that performs dozens of engagements annually usually has mature workflows and reliable templates.

- Auditor qualifications: Look for staff with credentials such as CPA, CISA, or CISSP. A blend of accounting and technology expertise improves audit depth.

- Industry reputation: Check reviews, testimonials, and client lists. Firms that have served companies similar to yours often provide smoother engagements.

3. Review the Audit Process and Service Methodology

The firm should clearly explain how it conducts the engagement from readiness to reporting. The audit evaluates how well your systems and controls meet the Trust Services Criteria.

Ask about:

- Readiness assessment: A pre-audit review helps identify control gaps early.

- Scope definition: Clarify which systems, services, or locations fall within the audit.

- Fieldwork and evidence collection: Understand the evidence methods, tools, and estimated duration for your organization’s size.

- Reporting deadlines: Get clear expectations on draft and final report delivery dates.

- Follow-through support: Some firms help with remediation or ongoing testing after the audit. Continued engagement often improves long-term control maturity.

4. Match Firm Scale and Fit to Your Organization

A firm’s size and focus should complement your company’s complexity and growth stage. Firms that emphasize effective communication and a responsive approach often deliver smoother engagements.

Consider:

- Experience with similar organizations: Some firms specialize in startups or SMBs, while others serve only large enterprises.

- Team and office coverage: Larger firms may offer geographic reach; smaller ones can provide closer attention.

- Client prioritization: Ask whether your account will receive dedicated resources or compete with bigger clients for attention.

- Global reach: If your operations span regions, choose a firm with experience handling multi-jurisdictional requirements.

- Cultural fit: Communication style and collaboration matter. The right partner will match your internal pace and working style.

5. Review Scope, Pricing, and Deliverables

Transparency around cost and deliverables avoids unpleasant surprises. Discuss whether the firm uses any compliance platforms to organize evidence and documentation efficiently.

Discuss:

- What’s included: Confirm whether readiness support or remediation assistance is part of the engagement or billed separately.

- Scope documentation: Make sure the firm provides a clear outline of systems, boundaries, and applicable criteria.

- Pricing model: Determine if fees are fixed or variable. Fixed-fee structures give predictability, while hourly billing can lead to overruns.

- Market range: For reference, smaller U.S. firms often charge between $15,000–$30,000 for Type 1 audits and $30,000–$70,000 for Type 2 audits, depending on scope and readiness.

- Timeline: Confirm how long it typically takes from kickoff to report issuance and what materials your team must prepare.

- Deliverables: Ask whether you’ll receive draft versions, management letters, or remediation plans alongside the final opinion.

6. Evaluate Tooling and Automation

Technology plays a growing role in SOC 2 audits. Firms that use strong tooling can save time and reduce manual workloads through automation.

Look for:

- Secure client portals: A centralized platform for document upload, evidence tracking, and communication.

- System integration: Support for automated evidence collection from your IT environment, such as logs or configuration data.

- Ongoing compliance capability: Firms that integrate automation make it easier to maintain controls between audits.

- Reporting visibility: Ask about dashboards or progress trackers that show findings, remediation status, and audit progress.

7. Consider Post-Audit Support and Long-Term Partnership

A good audit firm helps your organization grow its compliance maturity beyond a single report. The right partner builds customer trust and offers continued guidance that ultimately contributes to long-term assurance.

Ask about:

- Remediation support: Whether the firm can guide you through corrective actions for identified gaps.

- Future audits: Whether the same team can handle subsequent Type 2 or expanded audits.

- Regulatory updates: Firms that publish thought leadership or host updates keep clients informed of evolving standards.

- Client service quality: Evaluate responsiveness, communication practices, and availability outside audit cycles.

- Conflict management: Confirm that the firm will maintain independence and avoid offering control design services during audit periods.

Which Firms Provide SOC 1/SOC 2 Audits?

SOC 1 and SOC 2 audits are performed by independent CPA firms that issue and sign the attestation report under AICPA standards. The Big Four accounting firms Deloitte, PwC, EY, and KPMG all provide SOC 1 and SOC 2 examinations for organizations of varying size and complexity. In addition to the Big Four, SOC focused audit firms like Schellman and A-LIGN also provide SOC 1 and SOC 2 audits.

When selecting an auditor, confirm the report will be issued through a licensed CPA firm and discuss independence limits if the same provider also offers readiness support, since AICPA-related ethics guidance places strong emphasis on independence for attestation work.

Red Flags to Watch For While Choosing SOC 2 Audit Firms

Don’t rush into selecting your SOC 2 audit firm. There are some red flags you should be aware of before approving anyone. Avoid any SOC 2 audit firm that has one or more of the following issues:

- Lack of clarity about audit scope: Vague description of systems, controls, or boundaries that could create organization fails scenarios later.

- Suspiciously low pricing: Pricing that seems far below market without an obvious reason (might indicate fewer resources or reduced rigor, affecting cost effectiveness).

- Independence conflicts: Audit firm offering both heavy consulting/design services and then auditing the same scope in the same period (independence issue).

- Extended timelines without explanation: Very long timelines without explanation (could imply understaffing or process inefficiencies, impacting service commitments).

- Speed prioritized over quality: Overemphasis on speed without equal attention to proper sampling or strict standards of testing.

- No verifiable references: Unable or unwilling to provide references or evidence of previous clients who have completed similar audits successfully.

- Little or no post-audit follow-up: Limited or no post-audit support or feedback on control improvement.

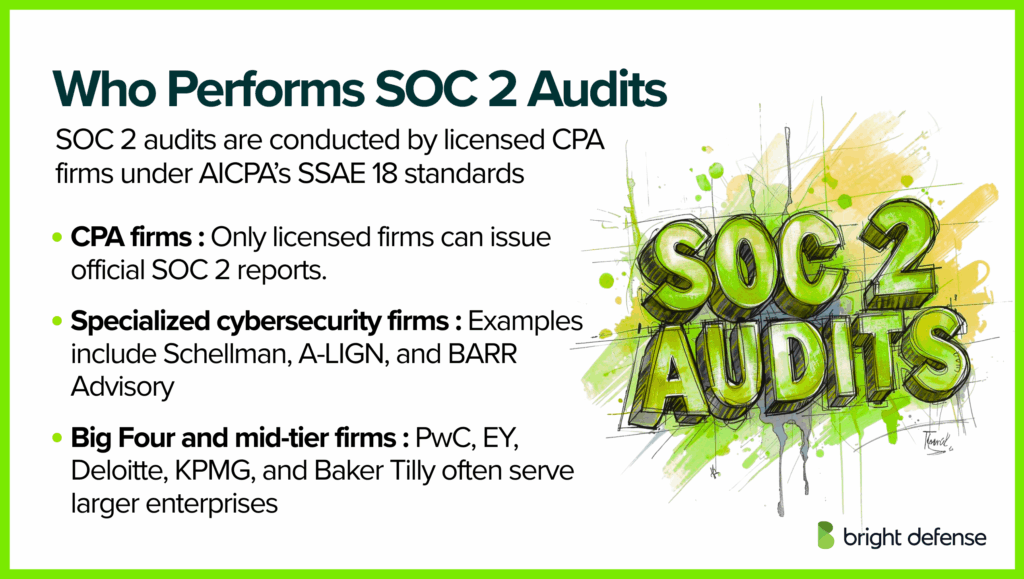

Who Performs SOC 2 Audits?

SOC 2 audits are carried out by licensed CPA firms that specialize in IT assurance and cybersecurity. The American Institute of Certified Public Accountants regulates these engagements under SSAE 18 standards.

Who performs them:

- CPA firms: Only firms with a valid CPA license can issue SOC 2 reports.

- Specialized cybersecurity firms: Some, like Schellman, A-LIGN, and BARR Advisory, focus almost entirely on SOC 2, ISO 27001, and related frameworks.

- Big Four and mid-tier firms: PwC, EY, Deloitte, KPMG, and Baker Tilly also perform SOC 2 audits for larger enterprises.

Best SOC 2 Auditors – Table

| Firm | Year Founded | Founders / Leaders | Headquarters | Key Attributes |

| Prescient Security | 2018 | Fabrice Mouret, Sammy Chowdhury | New York, NY | Risk based audits, 25 plus frameworks, CREST and CSA STAR certified, cloud native focus, AI supported testing, global team with 200 plus staff |

| Johanson Group LLP | 2014 | Stewart Riley; partners Tom Miller, Steven Miller, Ryan McBride | Colorado Springs, CO | Boutique CPA auditor, direct access to auditors, fast 4 to 6 week SOC 2 delivery, multi framework support |

| Sensiba LLP | 1977 | Steve San Filippo; led by CEO John D. Sensiba | San Ramon, CA | Top 100 CPA firm, B Corp, fixed fee pricing, AI assisted audits, strong automation tool experience, fast 30 day report cycles |

| Zero Day CPA | Early 2020s | Lance Samona | West Bloomfield, MI | SOC plus HIPAA focus, flexible remote or onsite audits, customizable Type I, II, and II plus engagements, transparent communication |

| Insight Assurance | 2019 | Jesus Jimenez, Felipe Saboya | Tampa, FL | Former Big Four leadership, AI driven workflows, 24 plus hour client access, multi framework capability across SOC, ISO, PCI, HIPAA, GDPR, and FedRAMP |

| PwC | 1998 (merger) | Samuel Price, William Cooper, others (legacy founders) | London, UK and New York, NY | Big Four scale, SOC 2 plus program, SECO multi attestation coordination, sector specific SOC reporting |

| BARR Advisory | 2014 | Brad Thies | Kansas City, MO | Accredited ISO 27001 cert body and SOC auditor, adaptive audit method that cuts client effort, remote first firm, fixed fee pricing |

| A-LIGN | 2009 | Scott Price | Tampa, FL | High volume auditor, A-SCEND audit platform, 31,000 plus audits completed, global offices and 400 plus auditors |

| Schellman & Company | 2002 | Chris Schellman | Tampa, FL | Specialized assessor, fixed fees, direct principal involvement, large SOC practice, quick 3 week draft and 30 day final delivery |

| Baker Tilly | 1931 | Ed Virchow | Chicago, IL | Global top ten CPA firm, SOC readiness and SOC 2 plus, strong multi framework integration, 140 plus country network |

| Linford & Company | 2008 | Homan Lajevardi, Dena Dahlquist | Denver, CO | SOC and HITRUST specialist, Big Four heritage, encrypted collaboration, remote friendly delivery model |

| Control Logics | 2008 | Homan Lajevardi | Tampa, FL | SOC readiness, SOX and ISO offerings, GDPR and CCPA guidance, senior consultants with 15 plus years experience |

| Oread Risk & Advisory | 2015 | Raja Paranjothi, Mihir Acharya | Olathe, KS | SOC specialty, long term relationship driven model, Tentacle tool integration, combined HIPAA, PCI, and ISO assessments |

FAQs

A SOC 2 Type 2 audit is an independent attestation that reviews a service organization’s systems and controls mapped to the AICPA Trust Services Criteria over a set period, usually 3 to 12 months. It assesses how well those controls operated in practice. The report includes the system description, management’s assertions, and the auditor’s test results. Type 2 focuses on operating effectiveness, while Type 1 assesses the design and implementation of controls at a specific point in time.

SOC 2 audits are conducted by independent Certified Public Accountants. The auditor must be a licensed CPA firm qualified to perform attestation engagements under AICPA standards. Insight assurance depends on whether the auditor applies consistent testing methods and maintains objectivity throughout the review.

Each organization selects its own CPA firm, which evaluates system controls and issues the SOC 2 report based on testing and evidence collected during the audit. Firms with a responsive team often communicate findings clearly and reduce delays.

SOC 2 audit-only costs typically range from about 7,000 to 60,000 for small or midsize organizations, while complex environments can exceed 100,000. When readiness assessments, compliance tools, penetration tests, and internal staff time are included, total first-year expenses often reach 80,000 to 350,000.

The final cost depends on scope, number of trust criteria, organization size, and fiscal year timing, along with any additional testing related to regulatory requirements or client requests. Working with a firm that maintains a strong track record of clear communication and reliability can also improve project predictability and client satisfaction.

Final Thoughts

Selecting a SOC 2 audit firm should go beyond checking compliance requirements. The leading firms in this list focus on understanding how an organization truly operates. They analyze systems, question weak spots, and leave clients with stronger security foundations.

A reliable auditor provides clarity instead of comfort. They explain control effectiveness, document real gaps, and help teams learn from the process. Firms that approach audits with honesty and precision build long-term credibility and measurable security maturity. Choosing that kind of partner turns SOC 2 compliance into an ongoing strength, not a yearly exercise.

Bright Defense Offers Continuous Cybersecurity Compliance Services

Bright Defense provides continuous cybersecurity compliance services that help SaaS and tech companies achieve and maintain SOC 2 requirements with expert support from CISSP and CISA-certified security professionals.

Our continuous compliance service includes gap assessments, risk assessments, policy generation, remediation support, compliance automation, managed security awareness training, and access to experienced vCISO guidance to strengthen security controls and support audit readiness.

For organizations focused on building trust with customers and partners, Bright Defense’s SOC 2 compliance solution boosts security posture and reduces the work needed for audit preparation. Contact Bright Defense to begin improving your SOC 2 compliance today.

Get In Touch