What is SOC 1 Compliance?

SOC 1 compliance is essential for service providers that manage financial reporting data. Part of the American Institute of Certified Public Accountants (AICPA) Service Organization Control framework, SOC 1 focuses on controls relevant to a client’s internal control over financial reporting, following SSAE 18 guidelines.

It applies to organizations such as payroll processors, payment service providers, and accounting platforms, confirming that their controls support accurate, reliable financial reporting and reduce the risk of errors or misstatements. Achieving compliance meets audit requirements, strengthens risk management, and shows the ability to protect sensitive financial information against errors or malicious activity.

This guide explains what SOC 1 compliance involves, why it matters, and how to prepare for a successful audit.

Key Takeaways

- SOC 1 compliance verifies controls for accurate financial reporting under AICPA SSAE 18.

- Required for service providers handling client financial data to meet client, auditor, and regulatory needs.

- Reports include Type 1 (design) and Type 2 (design and operation), issued only by CPA firms.

- Requirements include control environment, risk assessment, activities, communication, monitoring, and documentation.

- Focuses on financial reporting, often paired with other frameworks for broader security.

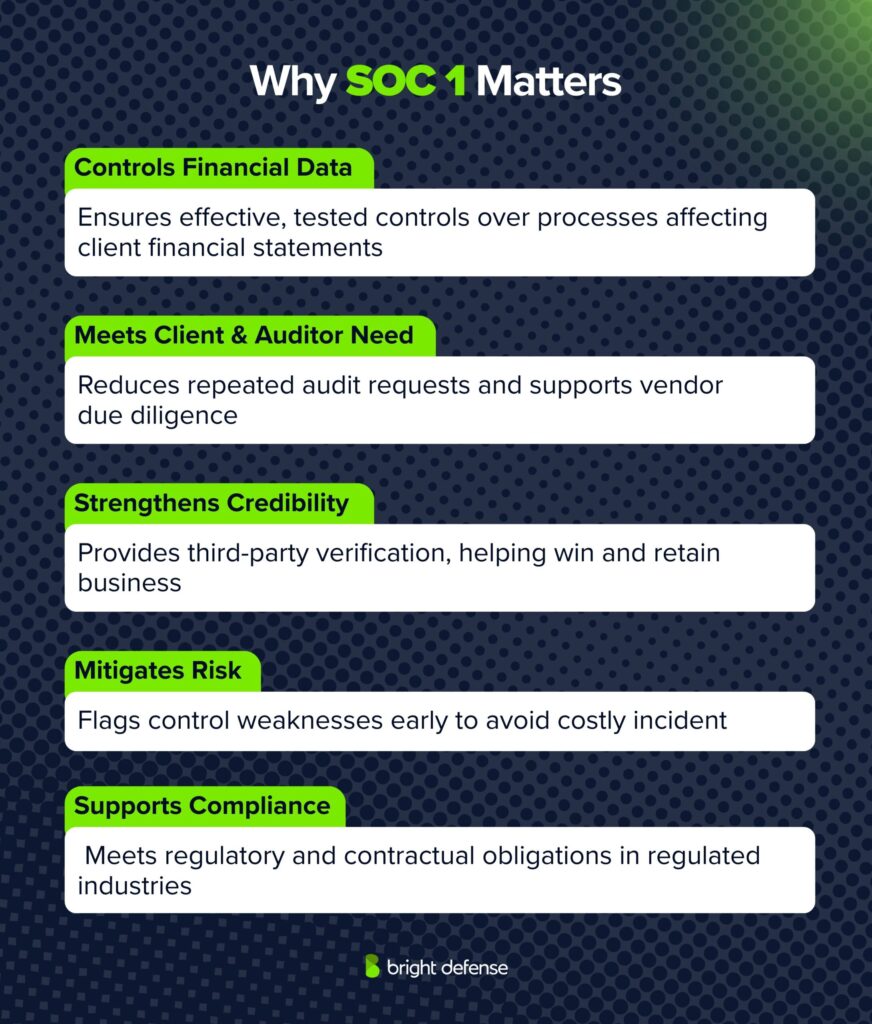

Why SOC 1 Is Important for Your Organization?

SOC 1 compliance plays an important role in protecting the integrity of financial operations and strengthening business relationships.

It confirms that controls are in place, meets key stakeholder requirements, and builds confidence in the organization’s processes. Below are some of the main reasons why SOC 1 is important for organizations:

1. Demonstrates Control Over Financial Data

SOC 1 compliance confirms that your organization has documented, tested, and effective controls over processes that can affect a client’s financial statements.

This assurance is particularly important for service providers that handle transactions, payroll, payment processing, or other finance-related activities. It shows that your systems operate in a way that protects against errors, fraud, and data integrity issues.

2. Meets Client and Auditor Expectations

Many clients, especially publicly traded companies, require SOC 1 reports as part of their vendor due diligence. Auditors rely on these reports to evaluate whether outsourced processes are operating effectively.

Without a SOC 1 report, you may face repeated audit requests from each client’s audit team, which can consume significant time and resources.

3. Builds Trust and Credibility

A SOC 1 report provides independent, third-party verification of your control environment. This reassures existing clients and strengthens your position when competing for new business.

Having an up-to-date SOC 1 report can shorten the sales cycle and remove barriers during contract negotiations.

4. Reduces Business Risk

SOC 1 compliance encourages proactive risk management by identifying control weaknesses before they result in operational or financial issues.

Addressing gaps during the SOC 1 process can help prevent costly incidents, protect your reputation, and maintain regulatory compliance.

5. Supports Regulatory and Contractual Obligations

In industries such as finance, healthcare, and insurance, a SOC 1 report is often not optional. It can be a contractual requirement or an expectation set by regulators.

Staying compliant keeps your organization eligible to serve clients in these highly regulated sectors.

When and Why Your Organization May Need a SOC 1 Report?

You will need a SOC 1 report if your services play any part in a client’s financial reporting process.

This applies whether you handle payroll, manage employee benefit plans, process stock transactions, run claims or loan servicing, or operate systems that feed financial data into your client’s books.

For many large companies, especially those that are publicly traded or heavily regulated, a SOC 1 report is something they will ask for during vendor onboarding, contract renewals, or when preparing for their own audits.

A SOC 1 report comes in two forms.

- Type 1 looks at whether your controls are designed properly at a specific point in time.

- Type 2 goes further and tests whether those controls work in practice over six to twelve months.

Most organizations choose a twelve-month review because it gives clients stronger assurance, though six months is the minimum accepted.

Since SOC 1 reports are often not shared publicly, we learn a lot from surveys. One study of over 1,700 CFOs, audit executives, and audit committee members showed that these reports play a big role in reducing financial reporting risks tied to vendors.

SOC 1 is about financial accuracy above all else. While some controls may touch on security, the main focus is ensuring that the financial data your systems handle is correct, complete, and reliable.

If a vendor’s systems feed into your financial reporting, you may also require them to have SOC 1 compliance. This keeps your reporting process consistent and gives everyone involved more confidence in the numbers.

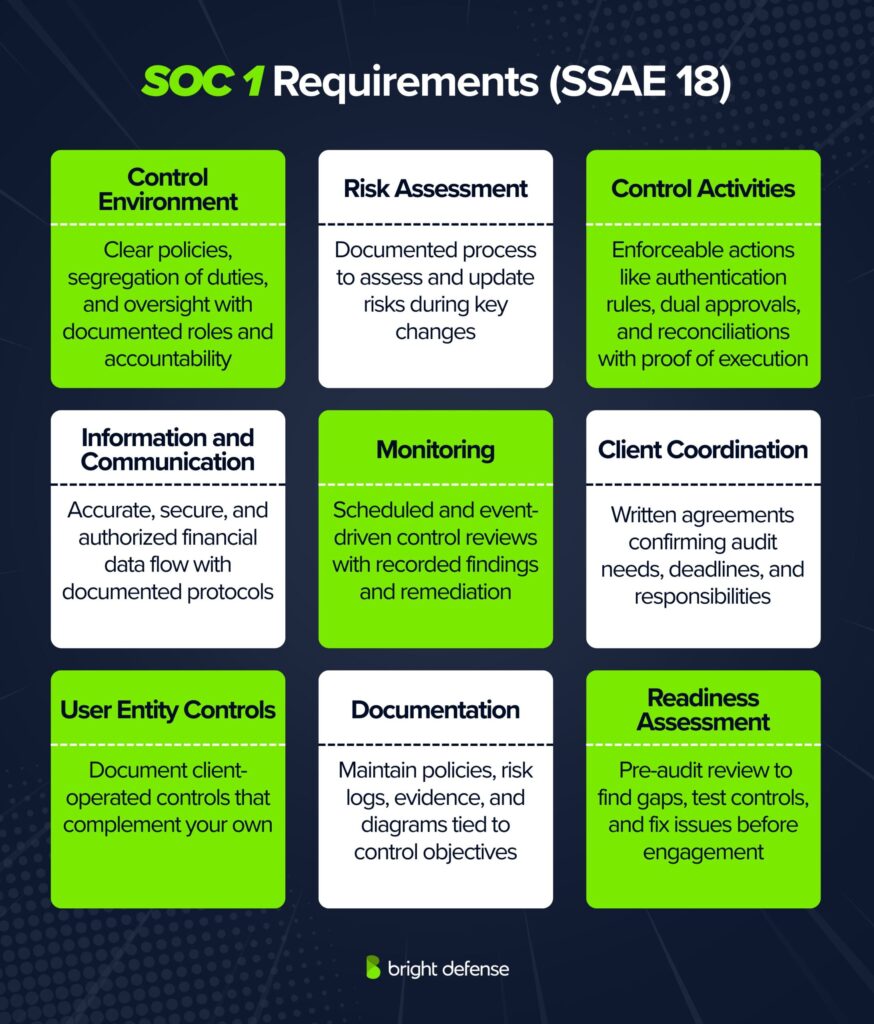

What are the Requirements to Meet SOC 1?

If you’re getting ready for a SOC 1 audit under SSAE 18, you must have controls that support Internal Control over Financial Reporting (ICFR). Here are the requirements you must meet to attain SOC 1:

1. Control Environment

Define clear policies, segregation of duties, and leadership oversight to prevent conflicts of interest. Organizational charts should show accountability lines, and job descriptions should reflect control responsibilities.

2. Risk Assessment Process

Use a documented process to identify risks that could cause financial misstatements. Reassess controls during events such as system changes, mergers, or policy updates. Keep records of risk registers, meeting notes, and approval logs.

3. Control Activities

Translate identified risks into enforceable actions. This can include authentication rules for financial systems, dual approvals for high-value transactions, and automated reconciliation reports. Maintain dated screenshots, system logs, and workflow approvals as proof.

4. Information and Communication

Ensure financial data is accurate, processed correctly, and accessible only to authorized personnel. Document communication protocols, data flow diagrams, and access control lists to show information moves securely between stakeholders.

5. Monitoring Activities

Review controls on a set schedule and after significant changes. Track findings, remediation steps, and follow-up testing in documented reports.

6. Client Coordination

Confirm client audit requirements and deadlines. Keep written agreements and correspondence that demonstrate alignment with client expectations and control responsibilities.

7. User Entity Controls

Document any complementary controls clients must operate, such as user access reviews or transaction approvals. Clarify how these work together with the service organization’s controls.

8. Documentation Requirements

Maintain written policies, risk assessments, evidence of control execution, organizational charts, and system diagrams. All evidence should be time-stamped and traceable to specific control objectives.

9. Readiness Assessment

Conduct a pre-audit review to identify gaps. Test controls internally, gather missing documentation, and assign remediation tasks before the formal SOC 1 engagement begins.

What is a SOC 1 Audit Report and Who Can Perform It?

Only an independent Certified Public Accountant (CPA) firm can issue a SOC 1 report

A SOC 1 audit report is an official review performed under the American Institute of Certified Public Accountants (AICPA) standards, specifically the SSAE 18 framework. Its goal is to assess how well a service organization’s controls protect the accuracy, completeness, and reliability of financial reporting. This can involve reviewing both business process controls and IT general controls, but only when they directly affect financial reporting.

Only an independent Certified Public Accountant (CPA) firm can issue a SOC 1 report. These firms must understand both IT systems and business processes that influence financial reporting. They can involve IT audit specialists to help with the technical parts, but the licensed CPA is the one responsible for the final opinion and the report itself.

When a SOC 1 audit takes place, the organization’s management provides a written statement describing the controls in place to meet specific control objectives. The CPA then tests those controls.

For a Type 1 report, the review focuses on whether the controls are designed properly at a specific point in time. For a Type 2 report, the testing also checks if the controls worked effectively over the review period. Unlike SOC 2, which follows set Trust Services Criteria, SOC 1 control objectives are unique to each organization’s processes.

Types of Auditor Opinions in a SOC 1 Report

- Unqualified – All control objectives tested were met, with only minor exceptions noted.

- Qualified – One or more objectives were not met, and the report explains why.

- Adverse – Major control failures kept objectives from being achieved.

- Disclaimer – The auditor did not have enough evidence to give an opinion.

SOC 1 for Financial Reporting

A SOC 1 report assesses whether a service organization’s financial reporting controls are suitably designed

A SOC 1 report evaluates whether a service organization’s controls that relate to financial reporting are suitably designed and, in the case of a Type 2 report, operating effectively over a defined period. It focuses on control objectives that support the accuracy, completeness, and reliability of financial data. Common areas include change management, transaction processing accuracy, segregation of duties, and logical or physical access restrictions.

Although some SOC 1 control objectives may touch on elements of information security, the primary scope is financial reporting. SOC 1 does not guarantee full protection of financial data from security threats or broader cyber risks. Its core value lies in giving auditors, management, and other stakeholders assurance—under the AICPA framework—that controls affecting financial reporting are in place and functioning as intended.

To address risks beyond the SOC 1 scope, organizations often supplement compliance with targeted cybersecurity measures, such as data encryption, multi-factor authentication, continuous monitoring, and vendor risk management. Combining SOC 1 with dedicated security controls reduces exposure to threats that a financial reporting control assessment alone does not address.

What are Control Objectives Within SOC 1?

Control objectives are specific goals that an organization’s controls aim to achieve to address risks affecting financial reporting accuracy and reliability.

In a SOC 1 audit, control objectives define the specific outcomes that an organization’s controls are meant to achieve in key process areas. These objectives address risks that could affect a client’s Internal Control over Financial Reporting (ICFR) and support data security as well as risk mitigation efforts.

They serve as the main reference points for deciding which controls, including appropriate controls and financial controls, need to be included in the SOC 1 review and tested during the audit process. Strong internal controls and a clear control objective statement give both management and business partners confidence in the organization’s ability to safeguard sensitive financial information.

A typical example could be:

Controls provide reasonable assurance that logical and physical access to programs, data, and computer resources related to financial reporting is restricted to authorized users, and that those users can perform only approved actions. This also supports maintaining compliance with applicable regulations and helps protect the user entity’s financial statements from errors or fraud.

It is management’s job to set these objectives, define procedures related to them, and implement thecontrols needed to meet them. During the audit, the CPA performs independent verification to determine whether the objectives are suitable for the organization’s environment and business model.

- In a Type 1 report, the review checks whether the controls are designed to meet the objectives.

- In a Type II report, the review also tests whether the controls operated effectively over the period being audited, producing a SOC report that may highlight key differences between the types. The results contribute to the compliance program and can impact customer trust, competitive advantage, and relationships with financial institutions.

What Are SOC 1 Service Organizations?

A SOC 1 service organization is a company that handles work affecting a client’s financial reports, like payroll processors, payment processing, or accounting services.

The American Institute of Certified Public Accountants (AICPA) describes it as any organization whose work can influence a client’s Internal Control over Financial Reporting (ICFR) or the service organization’s ICFR.

Think of activities like payroll administration, claims processing, transaction handling, loan servicing, or data hosting provided by cloud service providers. These are all functions that feed directly into a client’s financial statements and are considered part of the organization’s systems and services provided.

In many cases, the service organization’s controls are designed to meet trust service principles related to security controls, general controls, and control effectiveness.

These organizations go through a SOC 1 audit, which may include a point in time assessment, to show they have strong internal controls, control activities, and organization controls in place to keep client data and sensitive financial information accurate and secure.

If the controls are weak, whether due to system glitches, poor processes, mistakes, or even fraud, the client’s financial data could end up wrong or misleading.

A thorough and comprehensive assessment, supported by an audit report, helps demonstrate the organization’s commitment to ethical values and proper risk assessment.

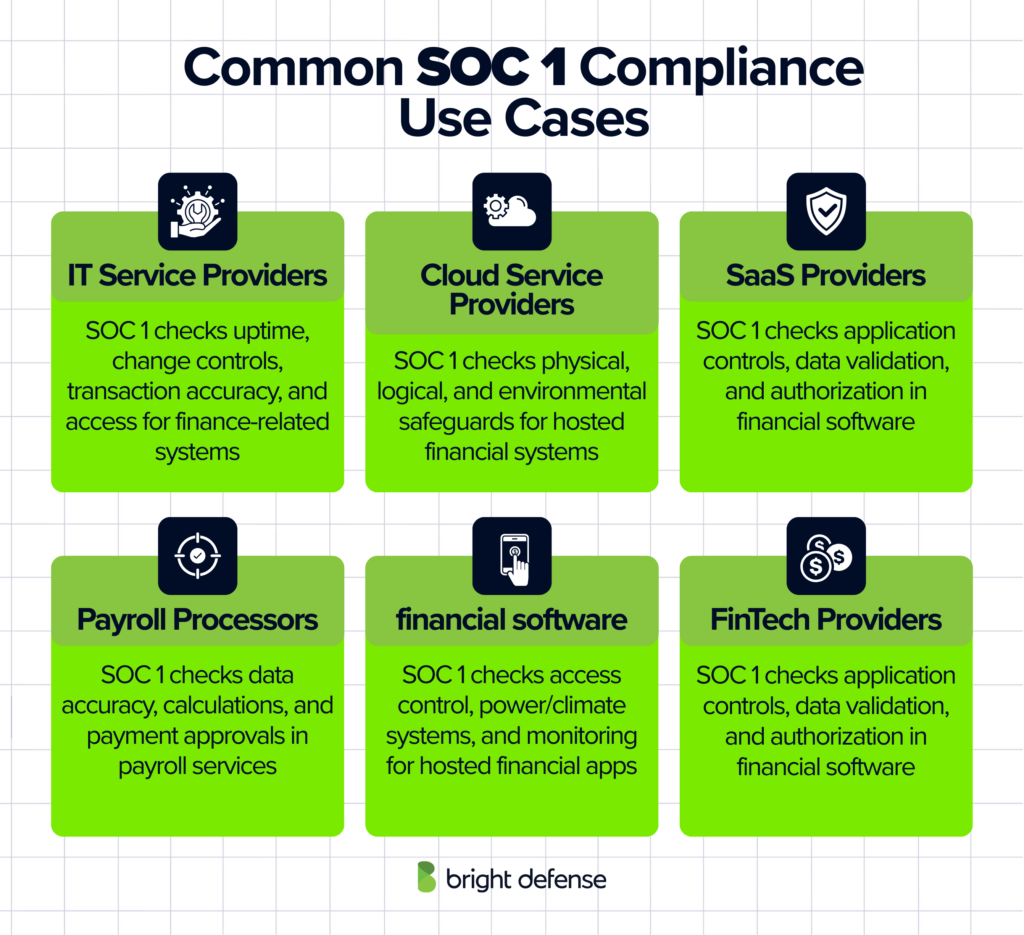

Common Use Cases of SOC 1 Compliance

SOC 1 compliance applies to service organizations whose operations can materially influence the accuracy, completeness, or reliability of a client’s internal control over financial reporting (ICFR). Here are some of the industries where SOC 1 compliance can prove vital:

1. IT Service Providers

Organizations that develop, operate, or maintain accounting, billing, or other finance-related applications may be in scope if a system outage, unauthorized change, or processing error could cause financial statement inaccuracies.

- Risks: Outages, unauthorized changes, or processing errors.

- SOC 1 checks: System uptime, change controls, transaction accuracy, and user access.

2. Cloud Service Providers

Hosting platforms supporting financial systems such as general ledgers, accounts receivable systems, or invoicing applications may require SOC 1 if their infrastructure or operational controls impact the completeness and accuracy of client financial data

- Risks: Infrastructure failures or poor operational controls that harm data accuracy.

- SOC 1 checks: Physical, logical, and environmental safeguards.

3. SaaS Providers

SaaS providers offer financial software platforms such as expense tracking, billing, or revenue reporting. If calculation errors, access breaches, or processing failures could lead to incorrect financial reports, SOC 1 evaluates application controls, data validation processes, and authorization measures.

- Risks: Calculation errors, access breaches, or processing failures.

- SOC 1 checks: Application-level controls, data validation, and authorization measures.

4. Payroll Processors

Providers that calculate payroll, tax withholdings, and employee benefits on behalf of clients may require SOC 1 if errors or unauthorized changes could materially affect client financial statements.

- Risks: Data entry mistakes or unauthorized changes affecting financial reports.

- SOC 1 checks: Data input accuracy, calculation checks, and payment authorization.

5. Data Centers

Data center facilities that host financial applications may need SOC 1 if physical or environmental control failures could disrupt data integrity or system availability.

- Risks: Physical or environmental issues affecting data integrity or uptime.

- SOC 1 checks: Access control, power and climate systems, operational monitoring.

6. FinTech Providers

FinTech Providers include payment processors, loan servicing systems, and investment platforms. If transaction errors, reconciliation issues, or weak controls could impact client reporting, SOC 1 assesses transaction accuracy.

- Risks: Transaction errors, reconciliation issues, or weak controls.

- SOC 1 checks: Transaction accuracy, reconciliation completeness, and authorization processes.

What is the Difference Between SOC 1 Type 1 and SOC 1 Type 2 Reports?

A SOC 1 Type 1 report reviews whether controls are properly designed at a specific point in time, while a SOC 1 Type 2 report also tests their operating effectiveness over a defined period.

A SOC 1 Type 1 report reviews how a company’s controls are designed at a specific point in time and answers whether the controls are set up properly on that date. It focuses on whether the design could work, not whether it functions over time.

A SOC 1 Type 2 report covers the same controls but over a longer period, usually six to twelve months, and answers whether the controls work as intended during that time. It tests both the design and how the controls operate in practice.

| Feature | SOC 1 Type 1 | SOC 1 Type 2 |

|---|---|---|

| Focus | Design of controls at a specific date | Design and operating effectiveness of controls over time |

| Timeframe | Single point in time | Usually 6–12 months |

| Purpose | Confirms controls are set up properly | Confirms controls are set up and functioning as intended |

| Testing | Evaluates design only | Evaluates design and actual performance |

| Use Case | Initial review or readiness check | Ongoing assurance for customers and auditors |

How Can Bright Defense Help You?

At Bright Defense, we work closely with your team to make SOC 1 preparation clear and manageable. We start with a readiness assessment to understand your control environment and point out any gaps that could cause problems during the audit.

Together, we design and document controls that fit your operations for a Type 1 report, or we help you monitor and maintain those controls over the months needed for a Type 2 report.

Our team stays involved throughout the process, helping you gather evidence, respond to auditor requests, and keep everything on track. We make sure you have the structure, clarity, and support needed to move into your SOC 1 audit with confidence.

FAQs

– SOC 1 centers on controls affecting financial reporting — Internal Control over Financial Reporting (ICFR).

– SOC 2 assesses controls tied to the Trust Services Criteria: security, availability, processing integrity, confidentiality, and privacy.

– SOC 3 covers the same criteria as SOC 2 but in a simplified, public-facing summary without detailed testing data.

Service organizations whose work may affect clients’ financial reporting, such as payroll processors, data centers, and third-party accounting services, typically need SOC 1 reports.

SOC 1 offers assurance to clients and their auditors that controls relevant to financial reporting are properly designed and operating effectively.

Type 1 is a point-in-time review of control design and can often be completed in weeks to a few months.

Type 2 tests the operating effectiveness of controls over a set period, usually six to twelve months.

Valid evidence includes system configurations, transaction logs, access control records, change management tickets, reconciliations, and documented approval workflows.

Key documentation includes process narratives, control descriptions, policies, procedures, system architecture diagrams, and evidence showing that controls operate as intended.

These are responsibilities the client must perform to complement the service organization’s controls and achieve control objectives.

SOC 1 may address cybersecurity risks only if they have a direct impact on financial reporting, and it is not intended to serve as a general cybersecurity standard.

Organizations often integrate SOC 1 requirements with other standards such as ISO 27001 or NIST to avoid duplicate work and maintain consistent controls.

SOC 1 focuses solely on controls that affect financial reporting and does not provide a full assessment of overall security, privacy, or resilience, so additional frameworks may be needed for broader protection.

SOC 1 directly addresses controls relevant to a client’s ICFR, and auditors often use these reports when assessing risk and planning financial statement audits.

Get In Touch