Tim Mektrakarn - CISSP | CISA | ISO 27001

July 3, 2025

How Much Does a SOC 2 Audit Cost in 2025?

Short Summary

- Updated for 2025!

- Traditional SOC 2 audit costs can range from $15,000 to over $100,000, depending on the type of audit and overall scope.

- Organizations must evaluate their needs and risks when determining Trust Services Criteria for effective cost management.

- Compliance automation software and expert guidance are strategies that can help reduce SOC 2 audit costs to $5000.

What is a SOC 2 Audit?

A SOC 2 audit is a formal examination of a company’s controls related to the handling of customer data. It was developed by the American Institute of Certified Public Accountants (AICPA). The audit evaluates whether an organization manages data according to specific criteria that help protect the privacy, security, and confidentiality of information.

The main purpose of a SOC 2 audit is to assess how well a company protects client information when it stores, processes, or transmits data. This is especially important for service providers such as cloud vendors, SaaS companies, and data processors.

How Much Does a SOC 2 Audit Cost?

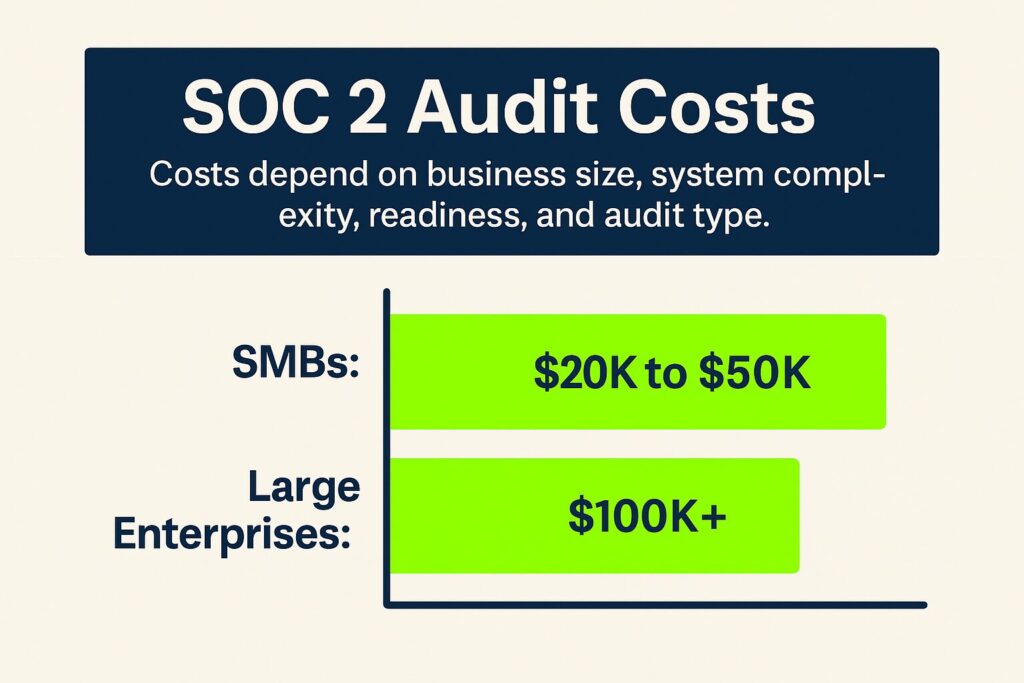

For small to medium-sized businesses (SMBs), the cost of a SOC 2 audit typically ranges from $20,000 to $50,000. Larger businesses may spend over $100,000 to achieve compliance. The exact cost depends on several factors, such as company size, system complexity, readiness, and the type of audit being performed.

The cost of a SOC 2 audit depends on numerous factors, such as:

- The type of audit

- Trust services criteria

- Organization size

- Complexity

- Level of automation deployed

Expenses that should be budgeted for when preparing for a SOC 2 audit include auditor fees, internal resource costs, technology and tool expenses, and any necessary remediation efforts to meet SOC 2 compliance requirements. It’s important for businesses to carefully consider these potential expenses and budget accordingly when planning for a SOC 2 audit.

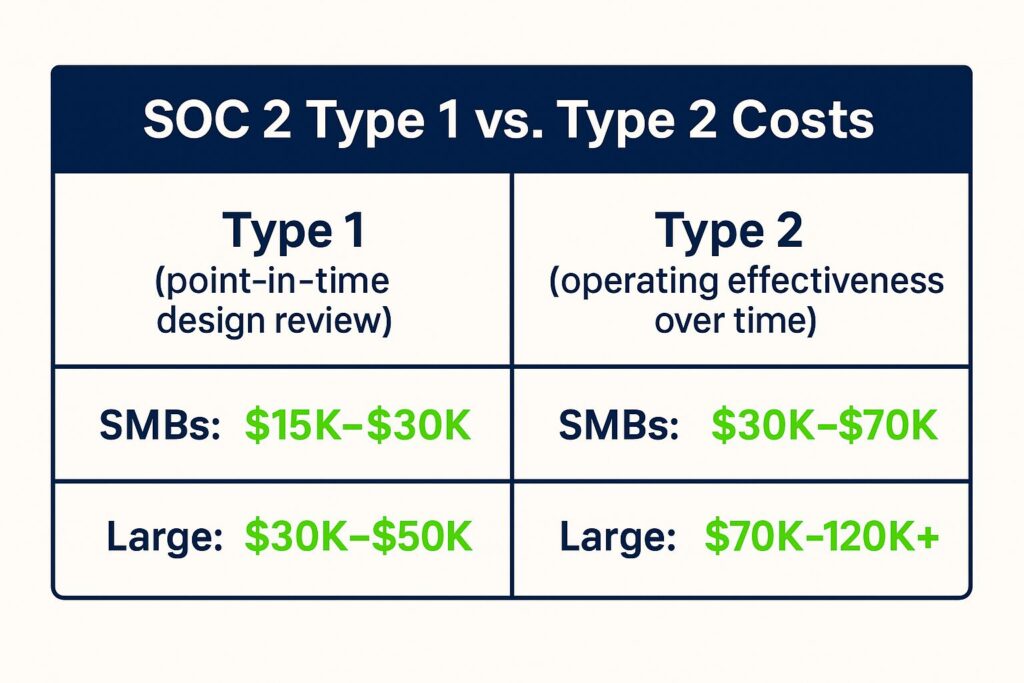

SOC 2 Type 1 vs. Type 2 Costs

The cost of a SOC audit can vary based on the type of SOC audit you are performing. Type 1 audits, which evaluate the suitability of the design of controls at a specific point in time, generally cost less than Type 2 audits, which assess the operating effectiveness of controls over a period of time.

Here is a detailed breakdown of the costs associated with each type:

SOC 2 Type 1

Type 1 audits review whether controls are designed appropriately at a single point in time. These audits work well for companies seeking a faster path to show initial compliance.

- SMBs: $15,000 to $30,000

- Larger businesses: $30,000 to $50,000

Type 2 audits evaluate whether controls operated effectively over a defined period (usually 3 to 12 months). They involve more evidence collection and typically cost significantly more.

SOC 2 Type 2

- SMBs: $30,000 to $70,000

- Larger businesses: $70,000 to $120,000 or more

Given the difference in cost and scope, businesses must carefully weigh the benefits of each audit type.

While Type 1 audits may be less expensive, they provide a limited assessment, focusing solely on the design of controls. In contrast, Type 2 audits offer a more comprehensive evaluation, measuring the effectiveness of controls over time and addressing the impact of annual security awareness training.

Type 2 audits typically have a minimum look back period of 3 months while 6 months is more common for the first audit followed by annual audits thereafter.

Some companies choose to perform a SOC 2 Type 1 audit initially in order to gain certification, then perform the SOC 2 Type 2 audit after they have a full 12 month period to certify. Ultimately, the choice of audit type should align with the organization’s oversight requirements and risk tolerance.

Additional SOC 2 Audit Costs

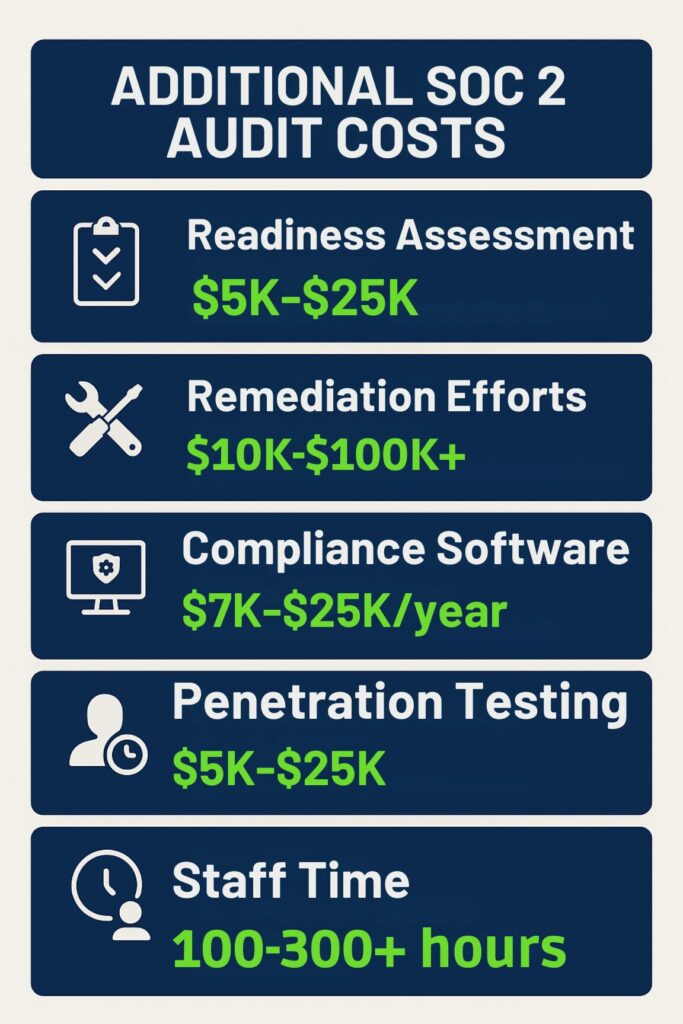

The direct audit fee is only part of the total expense. Several additional costs often come up during SOC 2 preparation and certification.

1. Readiness Assessments

Many companies use consultants or automated tools to conduct a pre-audit gap analysis.

- Typical range: $5,000 to $25,000

2. Remediation Costs

If the readiness assessment identifies gaps, remediation may include:

- Policy creation and documentation

- Control design and implementation

- Infrastructure or system updates

- Access control changes and role assignments

- Typical range: $10,000 to $100,000+

(Varies depending on control maturity and scope of remediation)

3. Compliance Software Platforms

Automation platforms simplify evidence collection, policy management, monitoring, and auditor collaboration.

- Annual fees: $7,000 to $25,000/year

(Depends on features, integrations, and number of users)

4. Penetration Testing and Vulnerability Scans

SOC 2 typically requires annual security testing to validate control effectiveness.

- Penetration testing: $5,000 to $25,000

- Vulnerability scans: $1,000 to $5,000

5. Staff Time and Internal Resources

Internal teams invest time for:

- Evidence collection

- Documentation updates

- Policy reviews and updates

- Ongoing monitoring and audit prep

- Effort: 100 to 300+ hours/year

(Varies based on team size, automation level, and scope)

6. Annual Re-Audits and Maintenance

SOC 2 Type 2 requires annual recertification to maintain compliance.

- Annual audit fees: typically 70% to 80% of the initial audit cost

- Ongoing internal monitoring and evidence collection adds recurring operational effort.

Benefits of SOC 2 Compliance

SOC 2 compliance provides a widely accepted way for organizations to prove they protect customer data and follow strict security controls. Let’s check out the benefits in a more detailed manner:

1. Strengthens Customer Trust

SOC 2 compliance gives customers confidence that their data stays secure. An independent audit verifies that controls are in place and working, which helps reassure clients, especially in industries handling sensitive information like finance, healthcare, and legal services.

2. Supports Sales and Market Access

Many enterprises require SOC 2 reports during vendor evaluations. Having a report ready speeds up sales cycles, simplifies security reviews, and opens access to larger deals and regulated industries. Without SOC 2, companies may face longer procurement processes or lose out on key opportunities.

3. Reduces Risk Exposure

SOC 2 pushes companies to implement strong controls, detect weaknesses early, and address vulnerabilities before they lead to incidents. The result is a stronger security posture, fewer disruptions, and lower financial or reputational damage when issues occur.

4. Encourages Internal Discipline

The audit process forces teams to document policies, track control performance, and build consistent procedures. This helps improve access controls, change management, vendor oversight, and risk assessments, making security part of routine operations instead of reactive fixes.

5. Simplifies Third-Party Risk Management

SOC 2 reports serve as standardized evidence that satisfies many security and compliance questions from customers, partners, and regulators. Sharing the report often reduces the need for lengthy security questionnaires and repeated audits from external parties.

Trust Services Criteria

Another critical factor influencing SOC 2 audit costs is the Trust Services Criteria, which are a set of requirements that must be fulfilled to achieve a successful SOC 2 audit. These criteria cover aspects such as:

- Security

- Availability

- Processing integrity

- Confidentiality

- Privacy

They may also require regular security awareness training and adherence to data protection policies to remain compliant. Most SMBs will do Security, Availability and Confidentiality. A lot of organizations think they need to do Privacy and Processing Integrity but there are very particular and specific criteria that you need to meet before considering expanding the scope of the audit to include these Trust Services Criteria as the scope of the audit greatly increases.

The number of Trust Services Criteria an organization chooses to include in its audit directly impacts the scope and cost of the SOC 2 audit. More criteria entail a more extensive audit process, which translates to higher costs. If a certain criterion is inapplicable or unimportant, it can be omitted. The remaining smaller subset of trust services criteria will be assessed in this situation.

It’s crucial for businesses to evaluate their specific needs and risks to determine the most appropriate set of criteria for their SOC 2 audit.

Preparation and Readiness Assessments Costs

Preparing for a SOC 2 audit is a vital step towards achieving compliance. Preparation costs and readiness assessments help organizations identify areas of non-compliance and outline the necessary measures to attain SOC 2 compliance, ultimately influencing overall costs.

These assessments may include gap analysis and remediation efforts, both of which play a crucial role in streamlining the compliance process and minimizing expenses, as well as addressing lost productivity.

Estimated Costs:

- Readiness Assessments: $10,000 to $17,000, depending on the size and complexity of your organization’s information security systems.

- Remediation Efforts: Costs can range from $10,000 to $100,000+, depending on the scope of necessary changes, such as policy creation, control implementation, and infrastructure updates .

Investing in thorough preparation can help reduce the likelihood of audit failures and additional expenses down the line.

Estimating the Cost of Compliance

SOC 2 compliance costs depend on several factors:

- Readiness Assessments: $5,000 to $20,000 to evaluate current compliance gaps.

- Consultants: $150 to $300 per hour for external expertise and guidance.

- Legal Paperwork: $10,000 to $30,000 for drafting policies, contracts, and procedures.

- Internal Labor: Varies based on staff hours and salaries for documentation, evidence gathering, and audit preparation.

- Infrastructure: $20,000 to $100,000 for new systems, tool upgrades, or control implementations.

A SOC 2 Type 1 audit reviews controls at a single point in time and typically costs less. A Type 2 audit covers control effectiveness over several months, increasing costs due to extended monitoring, evidence collection, and testing.

Understanding these categories helps organizations budget accurately for SOC 2 compliance.

Factors Influencing SOC 2 Audit Costs

SOC 2 audit costs are not fixed. They vary widely based on multiple technical, organizational, and operational factors. Understanding these drivers helps organizations avoid underestimating both financial and resource commitments.

1. Scope of the Audit

The audit scope directly impacts cost. Key scope elements include:

- Number of systems and environments: More cloud platforms, applications, or data centers increase the volume of controls and evidence.

- Number of locations: Multi-site operations add complexity.

- Customer data types handled: Sensitive or regulated data (e.g. healthcare, financial) may require additional controls.

- Number of trust service criteria (TSC):

- Security is mandatory.

- Availability, Confidentiality, Processing Integrity, and Privacy are optional but often requested by customers.

- Each added TSC expands auditor testing requirements.

The broader the scope, the more hours the auditor must dedicate to evidence review and control testing.

2. Type of Audit: Type 1 vs Type 2

- Type 1 Audit:

Assesses whether controls are properly designed at a point in time.

Shorter duration and lower cost. - Type 2 Audit:

Evaluates if controls operate effectively over a monitoring period (typically 3–12 months).

Requires continuous evidence gathering, live control operation, and expanded auditor review.

Type 2 audits are considerably more expensive due to time, labor, and control depth.

3. Readiness Level

The maturity of your security program before starting impacts both preparation and audit fees:

- High readiness: Mature policies, documented procedures, and established controls reduce preparation costs.

- Low readiness: Organizations lacking formal controls face higher costs for policy drafting, control design, remediation, and advisory services.

Often, a readiness assessment is necessary before formal audits, which itself adds cost but reduces audit failure risk.

4. Internal Team Involvement

Organizations that dedicate skilled internal compliance, security, and IT staff for audit preparation lower external consultant needs. Where internal expertise is limited, significant external advisory costs may be unavoidable.

Staff involvement includes:

- Evidence collection

- Documentation updates

- Policy writing

- Managing auditor communications

- Control operation monitoring

Internal labor cost can reach 100–300+ staff-hours across multiple departments.

5. Automation and Tooling

Automation platforms help reduce evidence collection time, maintain continuous control monitoring, and streamline auditor collaboration.

- Subscription platforms typically cost $7,000 to $25,000 per year.

- Effective automation reduces long-term labor costs and lowers auditor billable hours by simplifying access to evidence.

Organizations with manual compliance processes face higher recurring operational costs.

6. Remediation Work

Most organizations require remediation work to address gaps identified during readiness assessments:

- Policy creation

- Control development

- System hardening

- Role-based access control (RBAC) implementation

- Logging and monitoring upgrades

Remediation costs vary significantly: from $10,000 for minor adjustments to $100,000+ for substantial overhauls.

7. Auditor Selection

Auditor fees vary by:

- Firm size: Top-tier firms (Big 4 or national audit firms) charge premium rates.

- Experience level: Niche SOC 2 auditors often offer competitive pricing with deep technical expertise.

- Geography: Auditor rates differ based on jurisdiction, especially for international audits.

Typical audit fees:

- Type 1: $15,000 to $50,000

- Type 2: $30,000 to $120,000+

8. Annual Recertification

SOC 2 Type 2 audits require annual recertification. Organizations should budget for:

- Ongoing audit fees (typically 70%–80% of initial audit cost)

- Continuous evidence gathering and monitoring

- Regular policy reviews and control updates

9. Penetration Testing and Vulnerability Scanning

SOC 2 audits often expect annual penetration tests and vulnerability scans as part of security control validation.

- Penetration tests: $5,000 to $25,000 annually

- Vulnerability scans: $1,000 to $5,000

10. Legal and Contractual Requirements

Legal counsel may be required to:

- Review customer agreements

- Draft security policies

- Verify data protection clauses

Legal advisory costs may range from $5,000 to $30,000 depending on complexity.

Security Tools and Employee Training

SOC 2 compliance requires multiple security tools. Sencurity tools and employee training costs for SOC 2 includes the following:

- Antivirus Software: $30 to $100 per user per year

- Password Managers: $30 to $60 per user per year

- Vulnerability Scanners: $2,000 to $5,000 per year

- SIEM Tools: $5,000 to $50,000+ per year

- Security Awareness Training: $25 to $50 per user per year and upto $15,000 per session

Trains employees on security best practices and reduces the chance of user-related incidents.

These tools and trainings help detect and fix vulnerabilities, block cyber threats, and handle security incidents. A security-first culture also lowers the risk of breaches and data leaks. Using these tools and policies shows that the business protects sensitive information and keeps customer trust.

Knowing these costs allows businesses to plan budgets for SOC 2 compliance.

Security Tool Investments

Investing in security tools, such as:

- Vulnerability scanners (Rapid7, Qualys, Tenable)

- SIEM tools (Splunk, DataDog, FortiSIEM )

- Anti-virus software (SentinelOne, Microsoft Defender)

- Password managers (1Password, LastPass)

is essential for achieving SOC 2 compliance. These tools enable organizations to proactively identify and address security vulnerabilities, reducing the likelihood of costly breaches and compliance failures. Additional investments may be necessary to cover other native services provided by cloud service providers.

Vulnerability Scanners & Gap Analysis Cost

Start with a gap analysis to find weaknesses in codebases or hosting infrastructures. Assess the risks and potential impact of these vulnerabilities. If high-risk issues appear, consider vulnerability scanners, which cost $6,000 to $25,000. The cost should be weighed against the security risks identified.

Tips for a Successful SOC 2 Audit

Preparing for a SOC 2 audit requires planning, coordination, and ongoing attention. The following tips can help simplify the process and improve results:

- Start Early: Begin preparations well in advance of the audit. This gives ample time to address any potential issues or gaps.

- Engage Stakeholders: Ensure that all relevant departments and stakeholders are involved in the audit process. This ensures a holistic approach to compliance.

- Documentation: Maintain thorough documentation of all processes, controls, and procedures. This not only aids in the audit process but also helps in identifying areas of improvement.

- Continuous Improvement: Instead of viewing the SOC 2 audit as a one-time event, treat it as an ongoing process of improvement. Regularly review and update controls and procedures to stay compliant.

Summary

In conclusion, understanding the various aspects that contribute to SOC 2 audit costs is crucial for organizations looking to achieve and maintain compliance. By carefully considering factors such as audit type, trust services criteria, preparation and readiness assessments, auditor fees, legal expenses, security tool investments, employee training, and ongoing maintenance costs, businesses can effectively budget for SOC 2 compliance and proactively address potential challenges. With a comprehensive understanding of these costs and a commitment to continuous improvement, organizations can demonstrate their dedication to data security and protect their valuable assets and reputation.

About Bright Defense

Bright Defense protects our customers from cybersecurity threats through continuous compliance. We work with SMBs, SaaS providers, and MSPs to help them achieve SOC 2, HIPAA, and CMMC compliance. We utilize compliance automation tools to help reduce the burden of evidence collection to reduce overall audit costs and audit fatigue. Our experienced team of cybersecurity experts focuses on a risk-based approach to the compliance journey versus implementing controls to pass a certification.

Bright Defense was able to help a SaaS developer that has been achieving SOC 2 certification since 2018, reduce their annual SOC 2 audit costs by 66%. Bright Defense was able to implement Drata, a compliance automation platform along with our continuous compliance service offering that provides the customer with enhanced visibility, monitoring, and automation, all in all giving them better value for a similar annual expense!

Take control of your cybersecurity journey with Bright Defense’s Continuous Cybersecurity Compliance-as-a-Service packages, tailored to fit every stage of your SMB’s compliance needs. Choose from three comprehensive packages, all powered by a compliance automation platform, to secure your business’s future:

- Sentry: Perfect for DIY, IT-savvy firms with a solid security grasp. Leverage our vCISO expertise for Risk Assessments, Incident Response playbooks, tabletop exercises, BC/DR planning, audit preparation, Internal Audits, and IT Strategy development.

- Guardian: Our full-service option delivers a robust Information Security Program, covering all aspects up to pre-audit preparation. You have the freedom to introduce your auditor, ensuring a personalized compliance journey.

- Defender: The ultimate package, including all Guardian features plus an annual SOC 2 audit by a US-based AICPA firm and monthly vulnerability scans. This comprehensive plan offers unparalleled security assurance.

Embark on your compliance journey with Bright Defense today and secure your business with our expertly designed packages. Your cybersecurity compliance is our priority. Let’s defend your business together!

In addition to continuous compliance, we offer security assessments and remediation, virtual CISO (vCISO) services, and managed security awareness training.

Frequently Asked Questions (FAQs) about SOC 2 Audits and Related Services

A SOC 2 audit is a comprehensive evaluation of an organization’s controls related to security, availability, processing integrity, confidentiality, and privacy. It’s based on the Trust Services Criteria established by the American Institute of Certified Public Accountants (AICPA).

The cost of a SOC 2 audit can vary widely. For small to medium-sized businesses, it can range from $20,000 to $50,000, while larger businesses may see costs from $50,000 to $100,000 or more. Type 1 audits generally cost less than Type 2 audits. With a compliance automation software and expert guidance the price of a SOC 2 audit can dramatically reduce to starting at $5,000 for small business.

Type 1 audits assess the design of controls at a specific point in time and are generally less expensive. Type 2 audits evaluate the operating effectiveness of controls over a period of time and are more comprehensive and costly.

Factors include the type of audit, Trust Services Criteria chosen, organization size, complexity, level of automation deployed, and geographical location.

Benefits include enhanced reputation, competitive advantage, and reduced risk of data breaches.

These are requirements covering security, availability, processing integrity, confidentiality, and privacy. They are essential for achieving SOC 2 compliance.

Preparation includes readiness assessments, gap analysis, establishing internal controls, and remediation efforts to meet compliance requirements.

Yes, any CPA who is independent and accredited by the AICPA can perform a SOC 2 audit.

These include yearly audits, continuous monitoring of information security management systems, and other recurring expenses necessary for ongoing compliance.

Implementing compliance automation software and seeking expert guidance can help streamline the audit process and potentially reduce costs.

Start preparations early, engage stakeholders, maintain thorough documentation, and treat the audit as an ongoing process of improvement.

Bright Defense offers continuous compliance, security assessments and remediation, virtual CISO services, and managed security awareness training.

Bright Defense implemented compliance automation tools and continuous compliance services, reducing annual SOC 2 audit costs by 66% for a SaaS developer client.

The cost typically ranges from $700 to $2500, a small investment compared to the potential costs of a cyber attack.

You can begin your continuous compliance journey with Bright Defense by contacting them for more information and tailored services.

Get In Touch